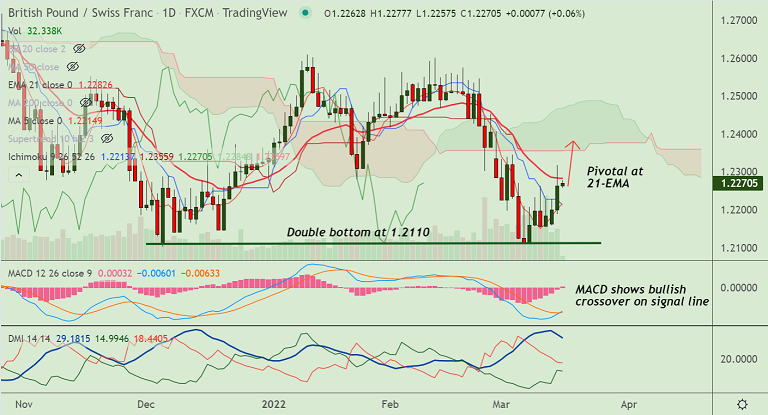

Chart - Courtesy Trading View

Technical Analysis:

GMMA Indicator

- Minor trend has turned bullish, major trend remains bearish

Ichimoku Analysis

- Price action is below the daily cloud

- Chikou span is biased higher, which may support upside

Oscillators

- Stochs show bullish rollover from oversold levels

- RSI is biased higher, but is below the 50 mark

Bollinger Bands

- Bollinger bands are spread wide apart, suggest volatility is high

Major Support Levels: 1.2215 (5-DMA), 1.2196 (200H MA), 1.2092 (Lower week BB)

Major Resistance Levels: 1.2282 (21-EMA), 1.2353 (55-EMA), 1.2403 (110-EMA)

Summary: GBP/CHF trades pivotal at 21-EMA resistance. Watchout for decisive break above for further gains. Next major bull target lies at 55-EMA at 1.2353.