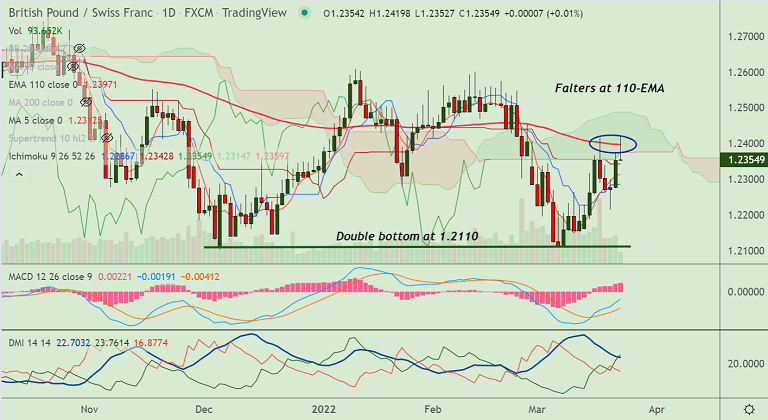

Chart - Courtesy Trading View

GBP/CHF slipped lower from session highs at 1.2419 and was trading at 1.2369, at around 10:30 GMT, up 0.12% on the day.

US-UK trade deal and hopes of firmer inflation figures will push BOE for faster rate hikes buoyed the pound.

However, intraday uptick lacked bullish conviction and the pair faltered just above the 110-EMA resistance.

Price action has retraced below 110-EMA and is hovering just above cloud base support. Close below cloud will dent further upside prospects.

Data released earlier on Wednesday by the UK Office for National Statistics showed UK headline CPI accelerated to 6.2% YoY in February from 5.5% in the previous month, beating expectations at 5.9%.

Meanwhile, core CPI jumped to a 5.2% YoY rate during the reported month as against 4.4% in January, also above forecasts at 5%.

Details of the report showed the annual Retail Price Index climbed to 8.2% from 7.8% as expected and the Producer Price Index (input) was up to 14.7% from 14.2%.

UK central bank also softened its language around the need for future rate hikes at its meeting last week, upbeat inflation has little impact on the pound.

Hopes that UK’s Chancellor Rishi Sunak will try their best to not disappoint votes during the Spring Budget communiqué keep downside cushioned.