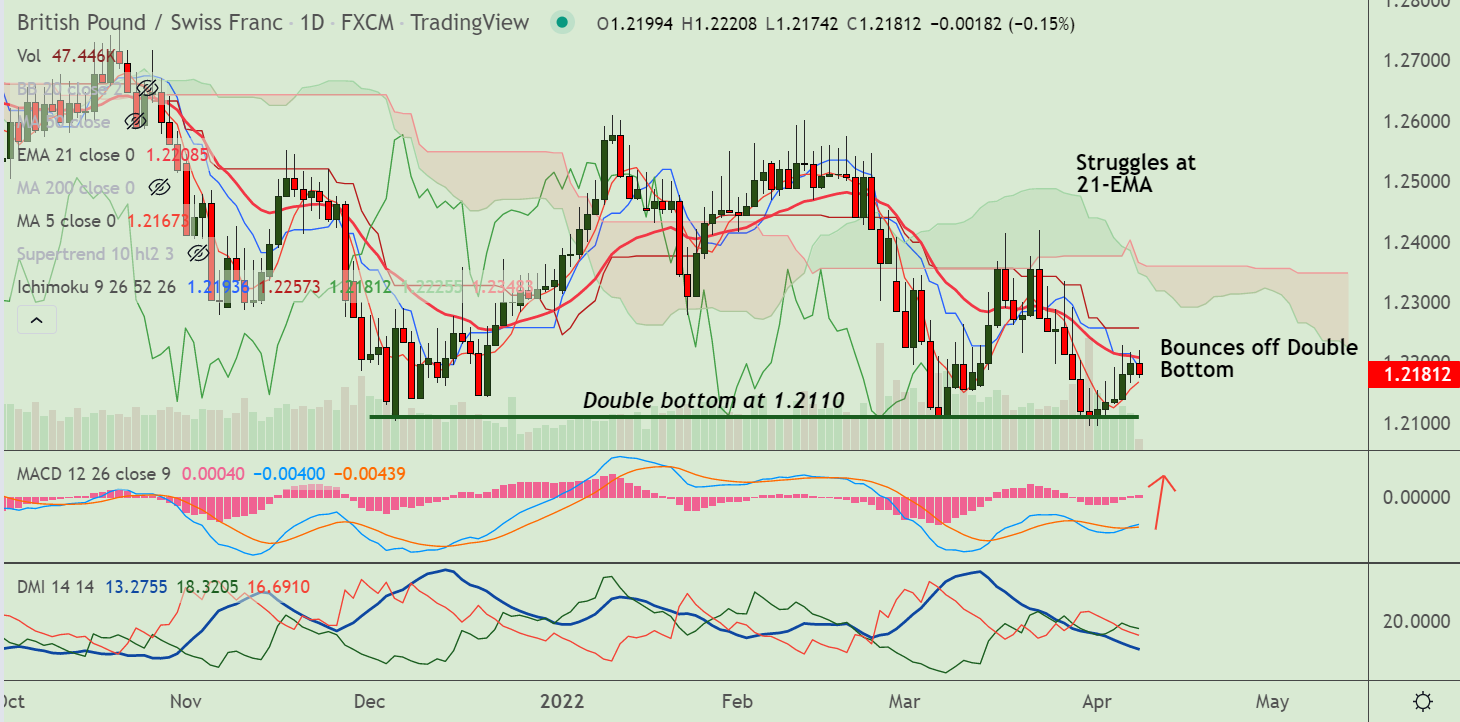

Chart - Courtesy Trading View

GBP/CHF was trading 0.26% higher on the day at 1.2273 at around 10:45 GMT.

The pair is extending previous session's gains and is hovering around 55-EMA.

Price action has bounced off major trendline support at 1.2110 on Wednesday's trade.

The pair has broken above 200H MA and GMMA indicator show bullish shift on the intraday charts.

Momentum has turned bullish. Stochs and RSI are biased higher. RSI is above 50 mark and Stochs are on verge of bullish rollover from oversold levels.

Major trend is bearish, but GMMA indicator shows bullish shift on near-term moving averages.

Support levels - 1.2203 (21-EMA), 1.2183 (5-DMA), 1.2110 (Trendline)

Resistance levels - 1.2271 (55-EMA), 1.2276 (Daily cloud), 1.2340 (110-EMA)

Summary: GBP/CHF on track to test daily cloud. Break above cloud will see bullish continuation.