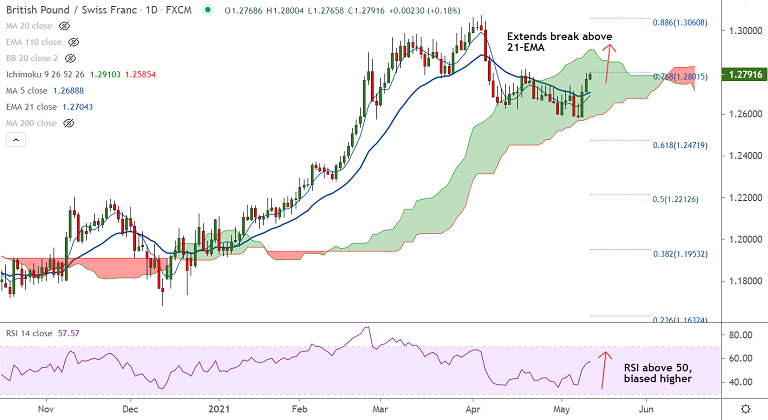

GBP/CHF chart - Trading View

GBP/CHF was trading 0.14% higher on the day at 1.2786 at around 08:50 GMT, outlook bullish.

The British pound was buoyed after Q1 GDP data released earlier today confirmed a brighter outlook for UK economy.

UK Q1 GDP contracted -1.5%, marginally less than the -1.6% consensus helped by a stronger March GDP reading. UK economy expanded by 2.1% in March.

Adding to this, the UK Industrial/Manufacturing Production figures and Goods Trade Balance also came in better than consensus estimates.

Technical bias for the pair is bullish. The pair was extending gains for the 3rd straight session,

Price action has bounced off cloud base support and has edged above 21-EMA. Volatility is rising as evidenced by widening Bollinger bands.

The pair was trading just shy of 1.28 handle which is immediate resistance at 76.8% Fib. Scope for test of cloud top at 1.2910.