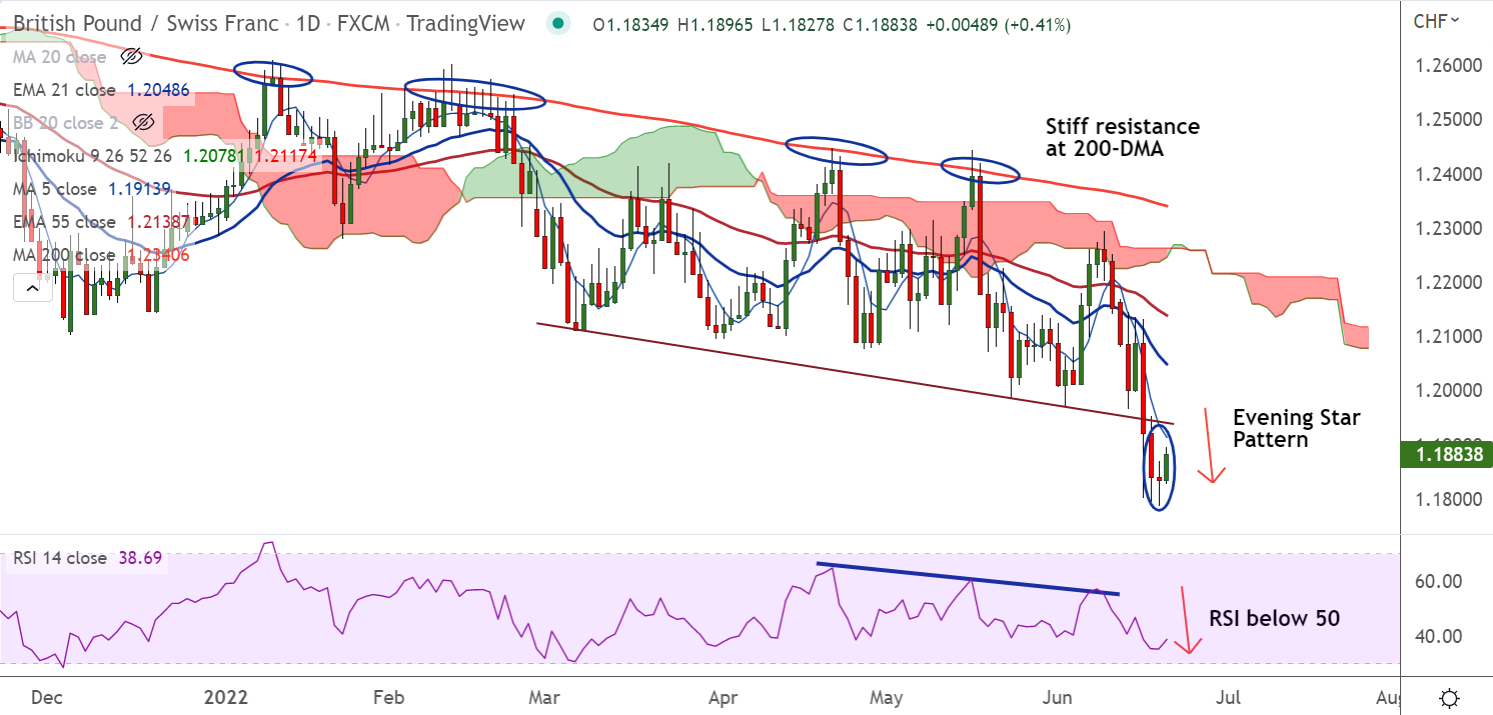

Chart - Courtesy Trading View

Spot Analysis:

GBP/CHF was trading 0.39% higher on the day at 1.1881 at around 09:30 GMT

Previous Week's High/ Low: 1.2169/ 1.1794

Previous Session's High/ Low: 1.1869/ 1.1787

Fundamental Overview:

An unexpected move of 50 basis points (bps) rate hike from the Swiss National Bank (SNB) has shocked the FX markets last week.

Investors await the release of the UK Consumer Price Index (CPI), which is due on Wednesday.

UK Office for National Statistics is expected to report the annual CPI at 9.1%, marginally higher than the former figure of 9%. Core CPI is likely to slip to 6% vs. 6.2% reported earlier.

Technical Analysis:

- GBP/CHF is consolidating previous session's slump

- GMMA indicator shows major and minor trend are bearish

- Momentum is bearish and volatility is high

- Morning Star pattern raises scope for some upside

Major Support and Resistance Levels:

Support - 1.1822 (Lower BB), Resistance - 1.1914 (5-DMA)

Summary: GBP/CHF rebounds with Morning Star pattern, however, major technical bias remains bearish.