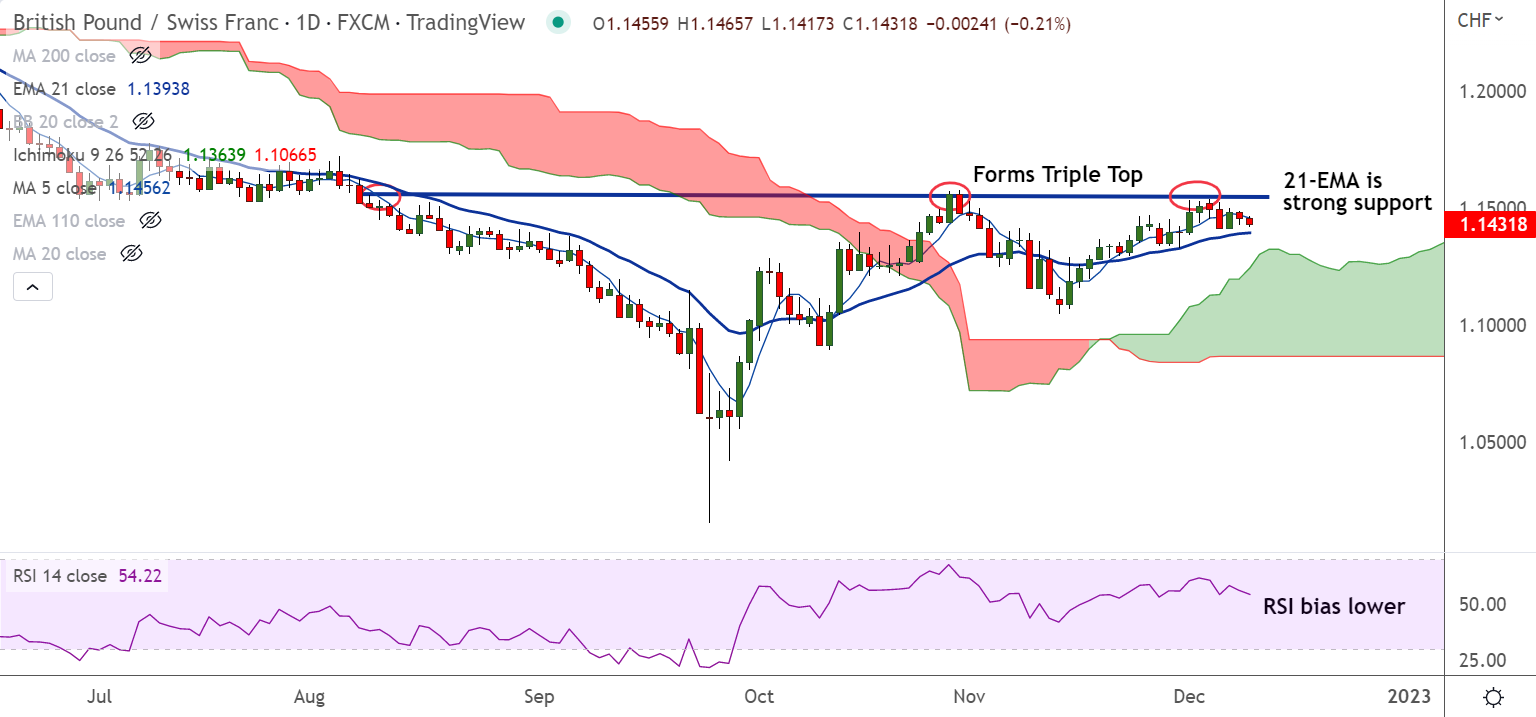

Chart - Courtesy Trading View

GBP/CHF was trading 0.29% lower on the day at 1.1422 at around 10:50 GMT. The pair is capped below 5-DMA and is on track to test 21-EMA support at 1.1393.

The British pound braces for the Bank of England’s (BOE) hawkish move during its next week’s monetary policy.

A Reuters poll stated that the BoE will announce another 50 basis points to hike next week, taking the borrowing costs to 3.50%.

The central bank is set for rate hike despite the economy falling into recession, as it battles inflation running at more than five times its target.

Next week's release of the UK inflation figures will also remain in the spotlight, rampant food price inflation could trigger upside momentum in overall inflation.

Expectations of a hawkish BoE along with easing of financial services rules for London adds strength to the pound, limiting downside in the pair.

Support levels:

S1: 1.1394 (21-EMA)

S2: 1.1333 (55-EMA)

Resistance levels:

R1: 1.1457 (5-DMA)

R2: 1.1583 (Upper BB)

Summary: The pair is extending weakness after formation of Triple Top at 1.1535. GMMA indicator shows trend has turned neutral.

21-EMA is strong support at 1.1394, break below will see more weakness. On the flip side, break above Triple Top at 1.1535 will see upside.