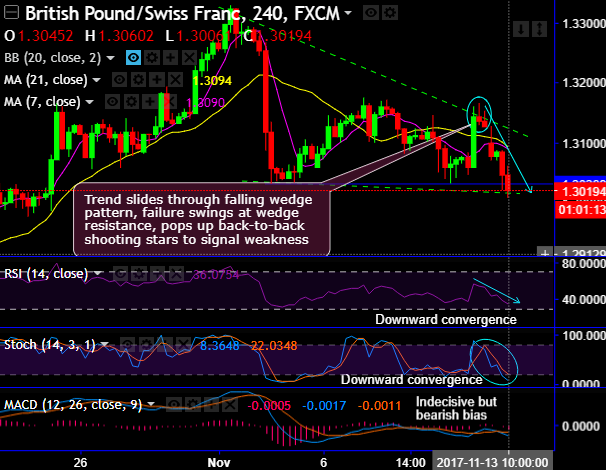

Chart pattern formed- falling wedge pattern.

Please be noted that the back to back shooting star patterns have occurred exactly at this juncture and they have shown their bearish effects so far.

Major supports are observed at 1.3030, and bears have managed to break the major supports at 1.3030, for now, the slumps upto 1.2900 seems most likely.

It is now attempting breach wedge baseline, expect more slumps upon this event as both the leading oscillators have been constantly converging downwards to signal weakness.

GBPCHF has shown a fake jump above trend line resistance and once again declined sharply from that level. The pair jumped till 1.31648 yesterday and tumbled sharply after UK political uncertainty. It is currently trading around 1.30235.

The pair tumbled after reports show that 40 MP’S are ready to sign no confidence against UK PM Theresa May. This is eight short of the number needed to trigger a party leadership contest.

The UK and EU concluded the sixth round of talks but a lot of issues to be fixed and EU’s Brexit negotiator has given UK deadline. He has asked the UK to move fast and clarify its position for further negotiations in Dec.

Any convincing break below 1.3030 will drag the pair to next level till 1.2975/1.2900.

The near-term resistance is around 1.3065 and any break above will take the pair until 1.3100/1.3175. Minor bullishness only above 1.3175.

Trade tips:

It is wise to short below 1.3030, but maintain a strict SL around 1.3065 for the TP of 1.2975/1.2900, we advocate stay shorts via one touch binary put options for a target of 25-100 pips that is likely to add magnified impact on the trade yields.

Alternatively, the aggressive volatility traders are advised to buy GBPCHF – EURCHF 2M straddle spreads on hedging grounds.