Chart - Courtesy Trading View

Spot Analysis:

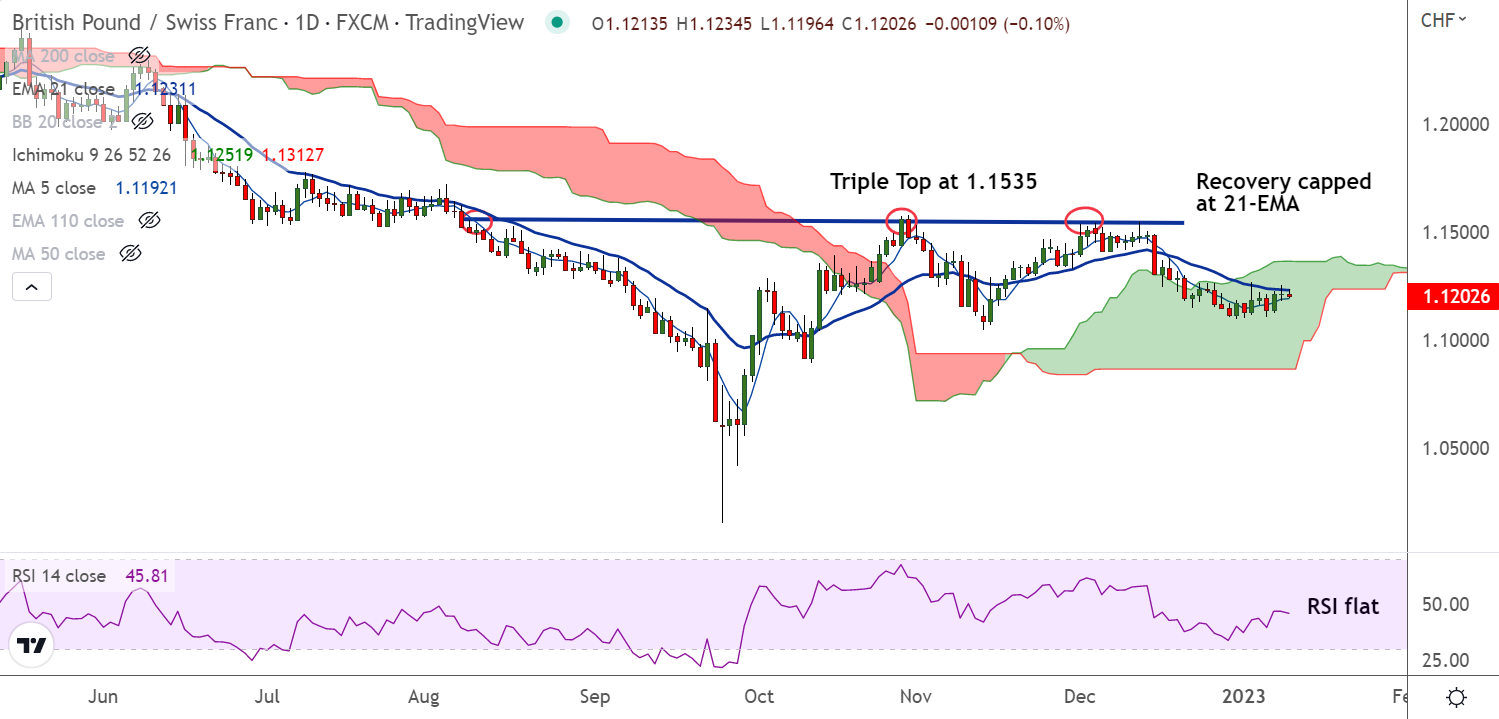

GBP/CHF was trading 0.09% lower on the day at 1.1200 at around 07:15 GMT.

Previous Week's High/ Low: 1.1268/ 1.1104

Previous Session's High/ Low: 1.1256/ 1.1179

Fundamental Overview:

Upbeat prints of second-tier UK data fail to overcome inflation woes. Traders fear that the UK inflation woes are strong enough to derail recently upbeat statistics.

Caution seen ahead of the key public appearance of Bank of England (BoE) Governor Andrew Bailey.

Selling pressure continues despite solid UK Retail Sales. British Retail Consortium (BRC) reported UK Like-for-Like Retail Sales (Dec) climbed to 6.5% vs. the former release of 4.1% on an annual basis.

Technical Analysis:

- GBP/CHF trades within the daily cloud

- Recovery attempts capped at 21-EMA

- Stochs are biased higher, RSI flat below 50

- MACD is on verge of bullish crossover on signal line

Major Support and Resistance Levels:

Support - 1.1191 (5-DMA), 1.1055 (Lower BB)

Resistance - 1.1230 (1-EMA), 1.1276 (55-EMA)

Summary: GBP/CHF finds stiff resistance at 21-EMA. Watch out for decisive break above for further upside.