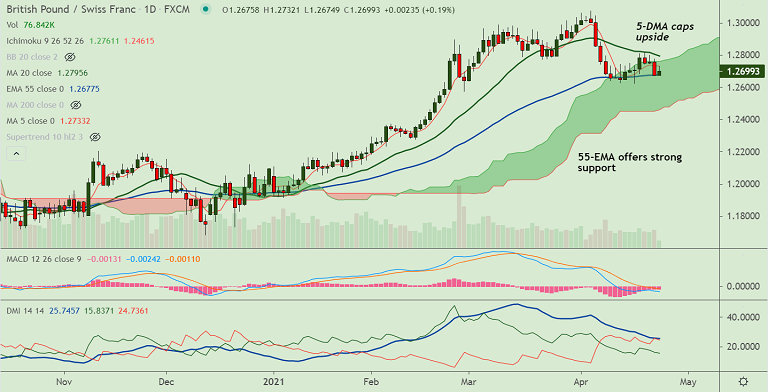

GBP/CHF chart - Trading View

GBP/CHF has edged slightly lower from session highs at 1.2732 as the pair struggles to extend upbeat data-led gains.

The pair was trading 0.23% higher on the day at 1.2704 at around 10:20 GMT, bias is neutral.

Upbeat UK Retail Sales and Preliminary Manufacturing PMI data keep the British pound supported.

The seasonally adjusted IHS Markit/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) jumped to 60.7 in April versus 59.0 expected and 58.9 – March’s final reading.

Meanwhile, the Flash UK Services Business Activity Index for April rose to 60.1 versus March’s final readout of 56.3 and 59.0 expected.

UK retail sales came in at 5.4% month-on-month in March vs. 1.5% expected and 2.1% previous. The core retail sales stood at 4.9% MoM vs 1.9% expected and 2.4% previous.

On an annualized basis, the UK retail sales rebounded by 7.2% in March versus 3.5% expected and -3.6% prior while the core retail sales jumped by 7.9% versus 4.5% expectations and -1.0% previous.

GBP/CHF price action remains capped between 20-DMA and 55-EMA. Breakout will provide a clear directional bias.