As there is SNB’s monetary policy is lined up for next week, where Libor rate is likely to remain unchanged again at -0.75%, CHF began losing its gaining traction against sterling.

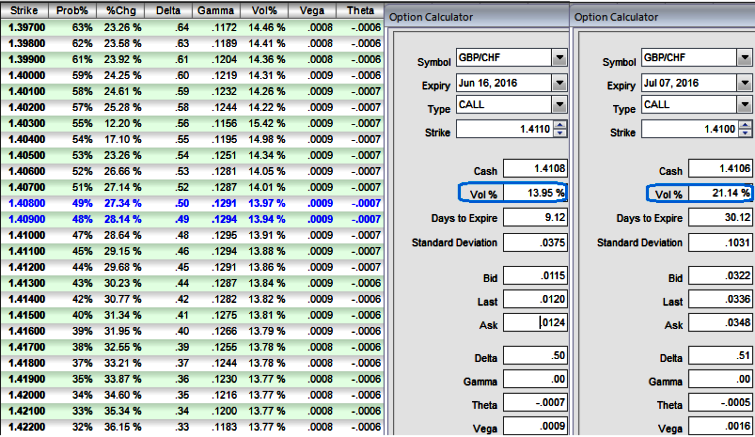

On the flip side, UK PMIs could not do much to propel IV factor GBPCHF nor does it manufacturing production that is scheduled for tomorrow, the consensus is unchanged from the previous flash at 0.1%. We see above reasoning in GBPCHF OTC, 1w ATM GBPCHF IVs are a tad below 14%, 21.14% for 1m tenors.

For today, no doubt upswings are rallying in abrupt but any continued downswings may turn adversely as we think the current downtrend holds stronger, so we've tailored our formulation of strategies as the risk appetite varies from different investors to different traders.

The naked at the money put option with 7 days expiry was highly sensitive to moves in the underlying exchange rate of GBP/JPY when gamma was at around 0.30.

Since 1w ATM volatility is perceived at 13.95% and it is likely to increase in the long run (for next 1 week to 1m span).

Because in the sensitivity table vega shows the sensitivity in option value for a corresponding shift volatility.

It is usually expressed as the change in premium value per 1% change in implied volatility.

With reducing volatility gamma adds to the risk and reward profile for both holders and writers but that is not happening here in this case.

Thus, on a hedging perspective in the long term, using vega factor debit put spreads are advocated so as to monitor the sensitivity and focus on payoff motive.

Hence, selling an Out-Of-The-Money put option is recommended to reduce the cost of hedging by financing long position in buying In-The-Money Puts.

However, speculators no worry to break your head, one touch 0.47 delta calls will come in your way to add leveraging effects of today’s rallies.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022