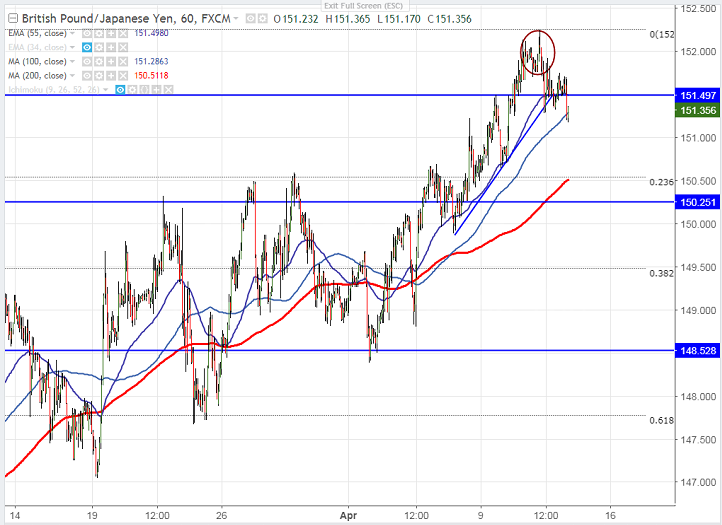

- GBP/JPY is consolidating in narrow range after continuous three week rally. The pair hits continuing its bullish trend for third consecutive day. The pair made fresh high for the week at 152.24 and showing a minor profit booking. US dollar index recovered sharply against all pairs on hopes of more than three rate hikes this year. GBP declined almost 50 pips from today’s high. Market eyes US jobless claims data for further direction. It is currently trading around 151.38.

- The major resistance is around 152.20 and any convincing break above targets 152.75/154.

- On the lower side, near term support is around 151.25 (100- H MA) and any close below will drag the pair till 150.50 (200- H MA)/150.05.

It is good to sell on rallies around 151.55-60 with SL around 152.20 for the TP of 150.50/150.