Overall trend of this pair fixes it bearish view for a target of 184.604 and may even tumble up to 182.420 in medium terms.

We think arresting this potential downside risks by hedging through Put Ratio back Spread is more effective hedging strategy than any other means.

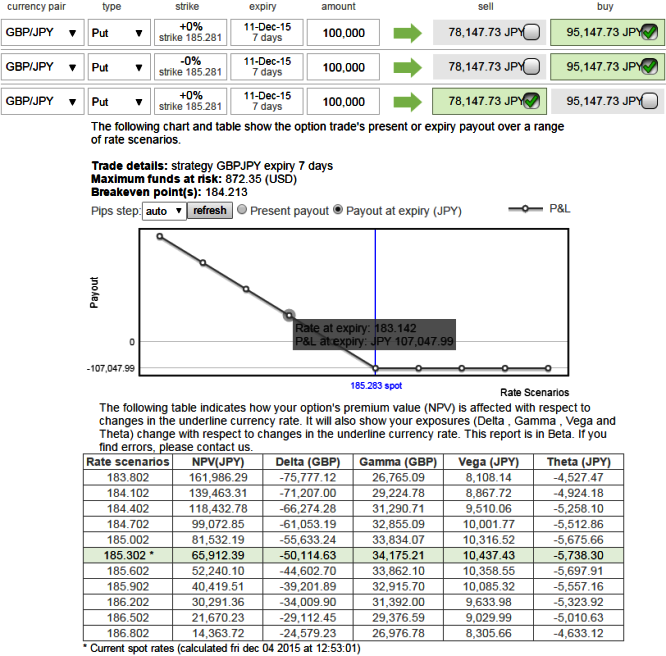

So, next big reason to worry would which strikes need to be selected. It's best to plug a back spread into the analyzer before doing the trade to see how the spread reacts to changes in the underlying price, time, and volatility.

We now reckon that the bearish patterns have more downside potential and would reveal a medium term downtrend direction.

Some intermediate uptrend is seen so far, the bearish turn to resume here onwards, long put instruments to generate positive cash flows as a result.

So, stay firm with longs on 2 lots of at the money -0.50 delta puts would function effectively.

Short 1 lot of ITM put option would generate assured returns on any abrupt rallies, shortly longs on ATM puts are about to function that would take care of potential downswings.

Alternatively, if they wish to short OTM instruments, they sell puts that has delta of less than 0.15. Which means they sell deep out of the money options. The idea behind this trade is that the chance of this option to expire worthless is 85%. (1-0.15 = 0.85 or 85%).

If they want to buy, they buy options that have delta of 0.5 or more which means they buy at the money or slightly in the money options.

The delta of a back spread or ratio spread is generally dominated by the option with the greater quantity the further it is from expiration. That makes sense, because the more days to expiration, the deltas of options are not as close to 0.0 or 1.00 as they are when there are fewer days to expiration.

FxWirePro: GBP/JPY PRBS for hedging - Stay cautious on delta while executing backspreads

Friday, December 4, 2015 9:03 AM UTC

Editor's Picks

- Market Data

Most Popular