Option Currency Hedging: Debit Put spreads

For today, no doubt upswings are rallying on this pair in abrupt but any continued downswings may turn adversely as we think the current downtrend holds stronger, so we've tailored our formulation of strategies as the risk appetite varies from different investors to different traders.

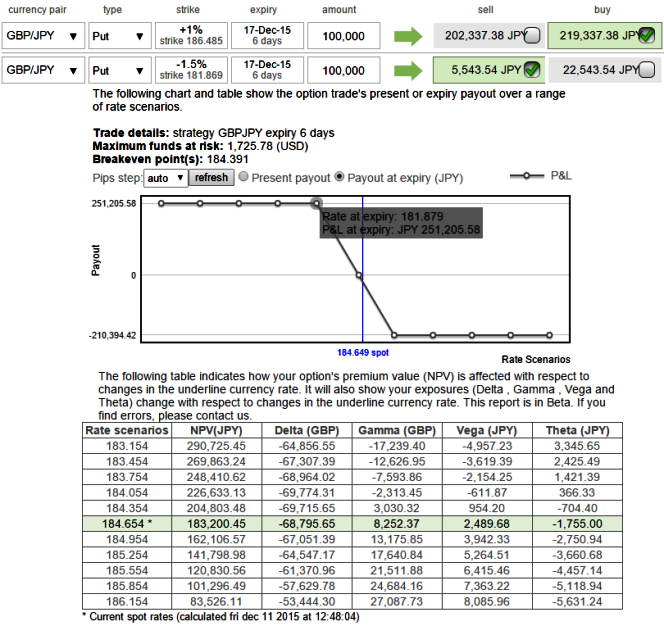

The naked at the money put option with 7 days expiry was highly sensitive to moves in the underlying exchange rate of GBP/JPY when gamma was at around 0.30.

1W ATM volatility is perceived at 9.40% and it is likely to increase in long run (for next 6 months to 1-year span).

Because in the sensitivity table gamma shows how much the delta will shift for a corresponding underlying rate moves by 1%.

With reducing volatility gamma adds to the risk and reward profile for both holders and writers.

Thus, on a hedging perspective in long term, using gamma factor in order to neutralize volatility factor, debit gamma put spreads are advocated so as to reduce the sensitivity and focus on hedging motive.

Hence, selling an Out-Of-The-Money put option is recommended to reduce the cost of hedging by financing long position in buying In-The-Money Puts.

However, speculators no worry to break your head, one touch 0.47 delta calls will come in your way to add leveraging effects of today's rallies.

FxWirePro: GBP/JPY debit gamma spreads ensure risk reward profile for risk averse; speculate via binary calls intraday

Friday, December 11, 2015 7:26 AM UTC

Editor's Picks

- Market Data

Most Popular