Japanese real exports fell in December but finished Q4 with a strong gain.

January flash manufacturing PMI for Japan edged up further; future output index signals a favorable outlook.

Japanese core CPI deflation continued through December, but inflation likely would be back in January.

The Cabinet Office’s new estimate of Japan’s potential growth rate is 0.8%, the output gap is less than 0.5%-pt.

BoJ monetary policy meeting did not add any uncertainty to the FX markets as they maintained status quo in bank rates, Japan’s preliminary GDP Q/Q, IP report, consumption and labor market indicators are scheduled for the week, while CPI and manufacturing production prints from UK’s perspectives are also scheduled for this week.

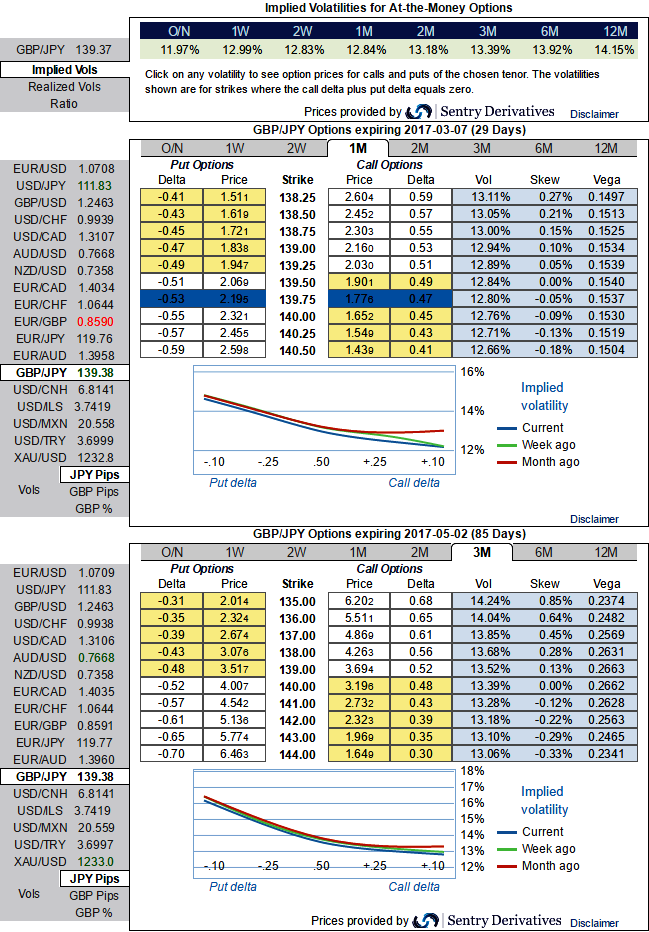

Despite GBPJPY downtrend seems to be intact, a lot of bad news is already priced in and digested by the market, preventing it from being overly bearish. Brexit caused two Sterling debacles, first in June with the vote and then after the summer when PM May suggested a hard exit. Cable lost almost about 15% over a quarter and it now seems the dust has settled. In the process, volatility fell but remained relatively high on a historical basis. Assuming a medium-term range in cable and that negative surprises are no longer market tail risks, the GBP volatility is still a short.

Hence, even if the aggressive volatility investors wants to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility. But further GBPJPY weakness and/or abrupt upswings suggests building a directional and volatility patterns at the same time: the value of OTM puts would unlikely to rise significantly as the IVs do not seem to be favoring these distant strikes. We, therefore, recommend buying a 3m IV skews and risk reversal with ATM options.

Option Trade Recommendation:

In order to match above IV skewness for 1-3m tenors, we advocate initiating longs in 2 lots of 3m ATM -0.49 delta puts, while long in 1 lot of +0.51 delta call of 1m tenor, please be noted that the payoff function of the strategy likely to derive positive cashflows regardless of swings but more potential from 2 puts are more than 1 call.

The risk is limited to the extent of the price paid to buy the options.

The reward is unlimited till the expiry of the option.

Please note that the trader can still make money even if his anticipation goes wrong – but the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025