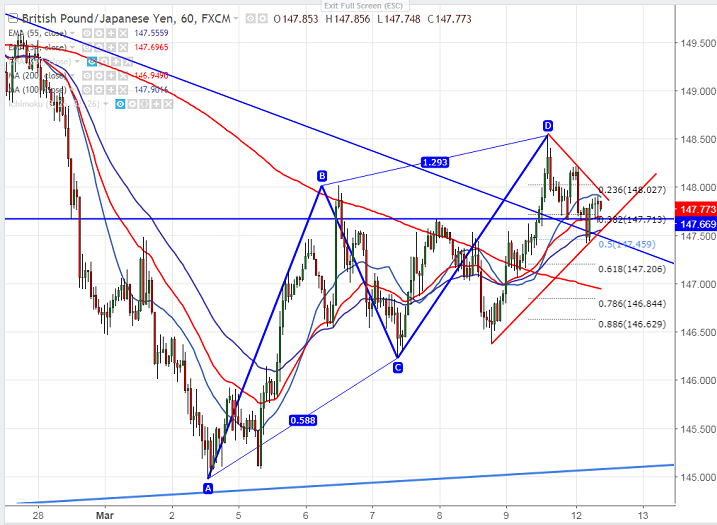

- Harmonic pattern – Bearish AB=CD pattern.

- Potential Reversal Zone (PRZ) - 148.55.

- GBP/JPY has shown a good jump on Friday and hits high of 148.54 and declined more than 100 pips from the high. The pair is currently trading around 147.77.

- The pair has formed Bearish AB=CD pattern in hourly chart and potential reversal zone is around 148.54 level. Any break above 148.55 will take the pair till 149/150.

- On the lower side, near term support is around 147.40 and any break below will drag the pair till 146.95/146.36.

It is good to sell on rallies around 148.35-40 with SL around 149 for the TP of 147.