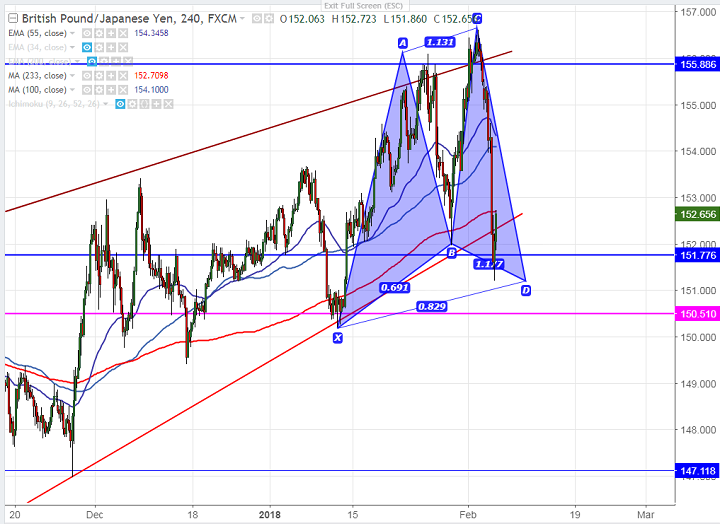

- Harmonic pattern- Bullish Shark pattern.

- GBP/JPY has shown a huge decline of 300 pips from the high of 156.60. The major reason for decline was increase of safe haven due to global sell-off in stock market. It has dipped till 151.20 and is currently trading around 152.65.

- The pair is recovering slightly from the low of 151.20 level. The near term resistance is around 152.70 (233- 4H MA) and any break above will take the pair to next level 153 (support turned into resistance)/154. Overall bearish invalidation only above 156.60.

- On the lower side, near term support is around 151.20 and any break below will drag the pair till 150.75/150.

It is good to buy on dips around 152.15-20 with SL around 151.20 for the TP of 153.50/154.