Technical Watch:

Bears resume after rejecting at major resistance at 162.702 & minor resistances at 161.702 and now at 156.853, as a result, the current price slid well below 7DMA and simultaneously the intermediate buying momentum seems disappeared. While both leading and lagging oscillators still signal downtrend momentum and its continuation.

Glimpse on macroeconomic view on UK and Japan:

We uphold the ongoing downtrend to prevail further. At spot ref: 155.196, the trader who believes that this week's economic numbers such as UK’s manufacturing production, UK’s trade balance, BoE’s inflation report and monetary policy and on the flip side, Japanese monetary policy minutes and their current balance would likely weigh GBPJPY rate.

The Bank of Japan (BoJ) maintained its QQE policy of raising the monetary base by JPY80tn on an annual basis and of continuing to apply its negative rate of -0.1% to the current account (policy-rate balance), while the market may continue to expect additional QQE.

The BoJ’s negative rate was probably the right decision, as without the move JPY could be much stronger.

Evidently, we’ve seen almost more than 15% drop in USDJPY in last 9 months, and more than 18.5% drop in EURJPY in 17 months, while GBPJPY slumps over 20% in just 11 months.

GBP/JPY OTC FX Observation and Hedging Strategy:

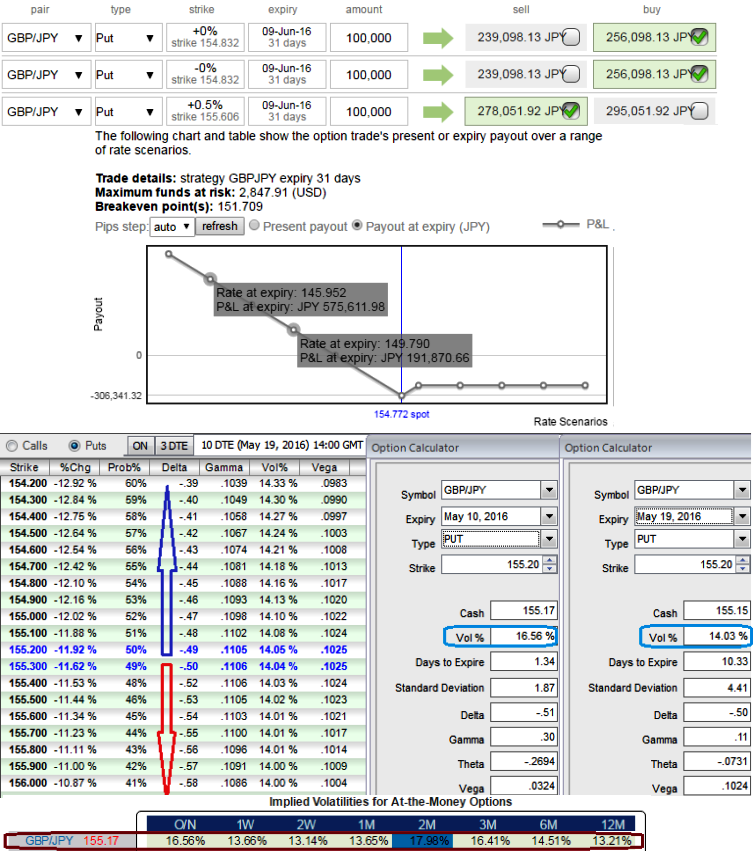

Please have a glance on how implied volatilities of ATM puts of 3W and 1M expiries are acting crazily in OTC markets, 13.74% and 13.08% respectively as last week’s UK’s manufacturing, construction & service PMIs were quite disappointing, whereas Japanese manufacturing PMI was able to produce upbeat number at 48.2 versus forecasts at 48.0 and previous numbers at 48.0.

So, it’s reckoned that these medium term volatilities are likely to reduce after manufacturing production and BoE's policy decision this week.

Officials are still expected to stand pat on the benchmark interest rate a record low 0.5% in coming month as well considering the fears of Brexit pressures.

Subsequently, what is weighing on the pound's slumps is that, the expectations on BoE’s unlikely changes, above all lingering Brexit probabilities add an extra pressure on sterling's depreciation. But IVs of 2 months tenor will pick up gradually during Brexit announcements.

Hence, we advocate the suitable strategy to hedge these downside risks by using these small bounces from then to help our ITM shorts, this would have certainly ensured returns in the form of premiums.

So, as shown in the diagram, on hedging grounds initiate longs on 2 lots of 1M At-The-Money -0.49 delta puts that would function effectively in considerably higher IV times (see sensitivity table for higher probabilities and stabilized Vega growth). Simultaneously, deploy shorts side of 1 lot of 1M (0.5%) ITM put option. The net delta should be around 44% and the positions could be entered with reduced debit.