GBP depreciated about 3% on a trade-weighted basis last week and is now slightly undervalued (2%), as perceptions of EU exit risk increased even though PM Cameron achieved an improved agreement with EU leaders and announced a 23 June referendum last weekend.

News that some key political figures have pledged support to the leave campaign has contributed to market concern. These have included London Mayor Boris Johnson and Justice Secretary Michael Gove, who has also questioned the legality of the deal.

The continuation in recent GBP weakness against the majors is possible this week as the February PMIs have been very poor than expected (50.8 vs forecasts 52.3). This adjustment could be helped if PM Cameron and his supporters gain traction on the merits of the deal. Whatever the case, we maintain our view that recent GBP weakness against the EUR is unjustified.

The UK's referendum on EU membership represents negative risks to Europe as whole, and UK economic activity remains superior to that of the euro area. GBP appreciation against the JPY remains unlikely, however, as the current poor risk environment should provide continued support for the JPY.

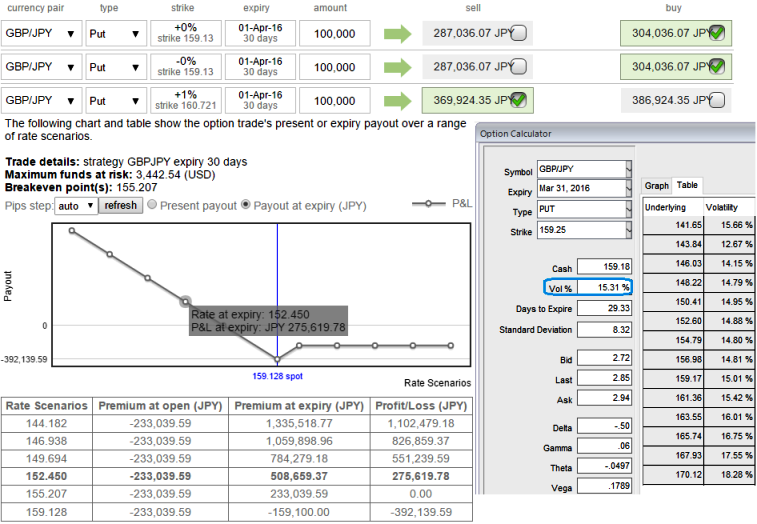

Having said that, we again stick onto longs in 2 lots of 1M At The Money -0.50 delta puts as it is likely to ensure positive cash flows more effectively. Simultaneously, write an In The Money put (1% upper strike) of narrowed expiry (preferably 1w tenor), this position is likely to take care of any abrupt upswings.

The rationale: Since the potential long term downtrend is anticipated, weights in the portfolio are to be doubled with ATM puts in order to give the leveraging effects. The profitability is optimally maximized for every shift towards downside as the 50% delta with longer tenor in the strategy is on competitive advantage and this is not probably the same on upside.

What makes ATM instrument more productive in our strategy and delta effects: The delta of this instrument is here at its fastest rate and gets faster as your position come closer to the expiration date.

As a result, time decay may have a relevant impact on ATM options. A higher absolute delta value is desirable for an option buyer.

ATM have the highest Gamma, Vega, and Theta which means their premium is the most sensitive to moves in either direction. The Delta of ATM options are 50%, which means there is an even likelihood of expiring ITM or OTM.

FxWirePro: GBP/JPY may collapse further - use ATM delta instruments for fresh backspreads to hedge

Wednesday, March 2, 2016 6:13 AM UTC

Editor's Picks

- Market Data

Most Popular