GBPJPY evidenced abrupt rallies after healthy manufacturing PMI data yesterday.

Although it is not going to be steep upward direction for today, there could either be sideways or inching higher until release of today's construction PMI.

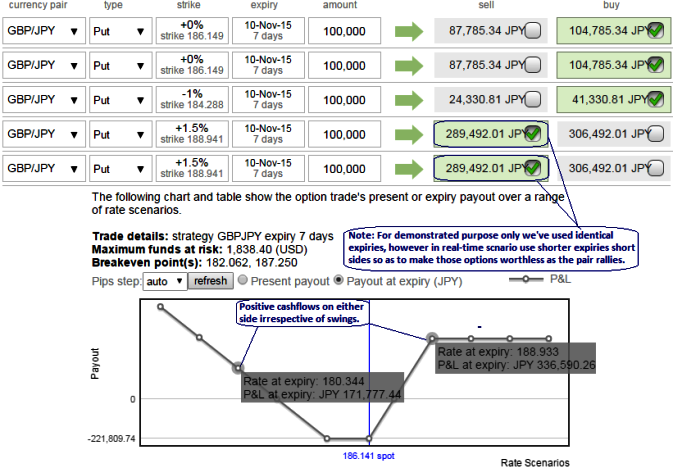

So, we now reckon that any upswings can be utilized by employing 2 lots of 1.5% ITM shorts in puts with shorter expiries. By now shorts side of 1 lots of ITM put option would have generated assured returns on the recent rallies.

We stated to maintain the same strategy for hedgers by using these small bounces from then to help our ITM shorts, this would have certainly ensured returns in the form of premiums.

Having said that, stay firm with any existing longs on at the money -0.50 delta puts as it would begin functioning effectively from recent past. Add one more long on 1% out of the money put in order to give leveraging effects to the portfolio with lesser cost of trade since we prefer OTM instrument.

Hence, as shown in the diagram the strategy is constructed in the ratio of 3:2 for net credit with net delta at -0.50.

Hereafter, you can have a view on daily charts (if the bearish signal pops up, long put instruments would be active and to generate positive cash flows here onwards).

We believe these bearish patterns have more downside potential and would reveal a medium term downtrend direction.

The purpose of this back spread in GBPJPY is that to profit on a quick extended move towards upswings on the eve of data releases (U.K's PMI numbers) that hints on GBP's gains, through and beyond the long strike. The purchase of a quantity of more long options is financed by the sale of fewer short options (But ratio is increased for leveraging effects).

The danger is that because the short options are closer to or in the money, they might grow faster than the long out-of-the-money options if the exchange price moves more slowly or with less magnitude than expected.

FxWirePro: GBP/JPY may extend gains – add 3:2 weights in backspreads

Tuesday, November 3, 2015 7:47 AM UTC

Editor's Picks

- Market Data

Most Popular