The Sterling and Yen remained in a holding pattern ahead of today’s BoE’s monetary policy, trade balance in UK and current account in Japan.

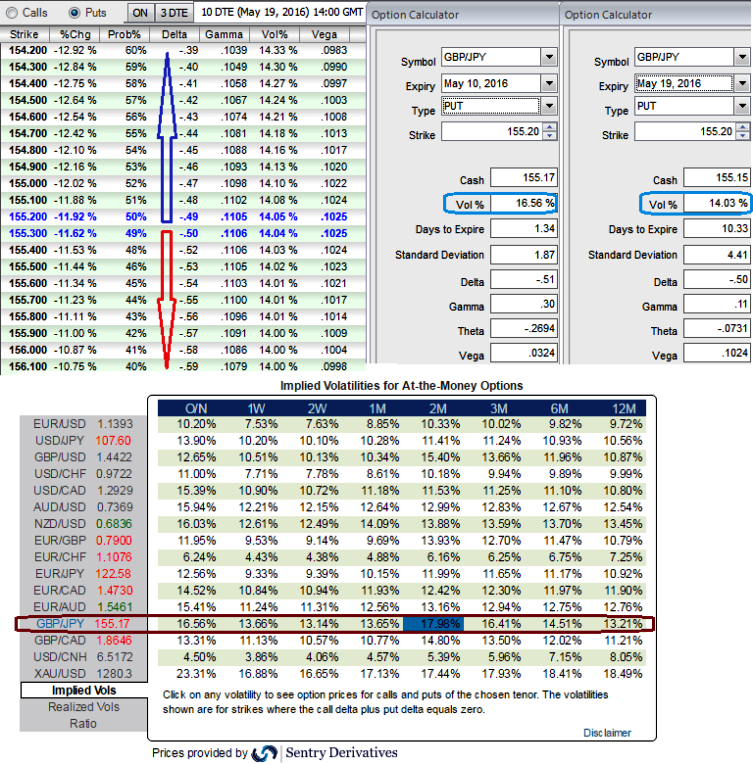

ATM IVs of 1D and 1W expiries are at 16.56% and 13.66% respectively.

IVs of 13.65% & 17.98% for 1M and 2M tenors respectively, so it has reduced a bit, however the volatilities implied in FX option market of this pair is likely to perceive lower volatility times even during UK’s monetary policy which is good news for option writers.

Vega is usually expressed as the change in premium value per 1% change in implied volatility.

Now, let’s glance on the sensitivity table for %change in every rise in GBPJPY OTM strikes, probabilities and their corresponding vega values, fluctuations on either side about 50 pips would not differ much in vega numbers despite the reducing IVs which means that higher chances of both ITM and OTM strikes of 50 pips expiring in the money are very high.

But, the volatilities would likely favour option writers as they are likely fade away.

Subsequently, have glance on sensitivity table as well for the different rate scenarios and their probabilistic outcomes. We've just referred 0.25% OTM put strikes and their vols, it still shows 0.47 as delta values for underlying outrights with 52% of probabilities, that means 52% chances of finishing in-the-money.

Usually, the options of ITM strikes are the most expensive, so buyers would pay the most and sellers would receive the most. Their premium is mostly made up of intrinsic value so they are relatively immune to Vega and Theta.

Vega is stagnant on either side, hence, trade an ITM option if you want to minimize the risk of Vega and Theta. They are an excellent tool when you have a strong view on the market because deep ITM options have the highest Delta. They will behave more like a position in the underlying.

On the flip side, OTM options are always the cheapest options hence buyers pay less and sellers receive less. They rely solely on extrinsic value and have a low Delta, Theta, and Vega. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Hence, OTM put options are the best suitable for those we seek long term hedging instruments for further downside risks and ITM options for short term.