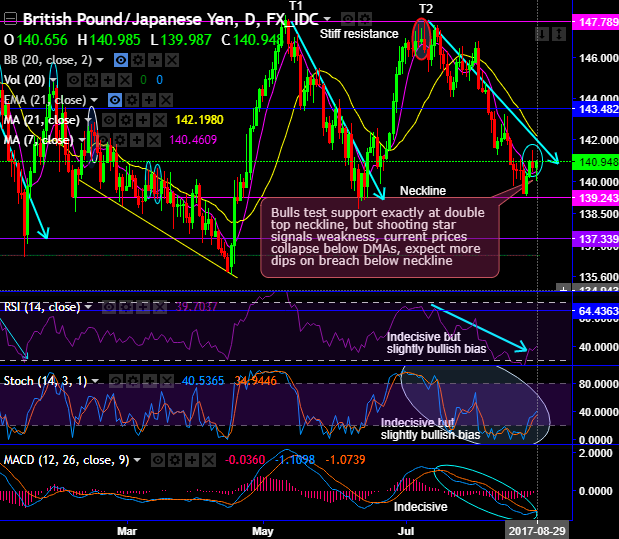

GBPJPY forms the double top pattern with peak 1 at 148.112, peak 2 at 147.778 and neckline at 139.243 levels. Ever since the bulls are rejected at peak 2, the prices have constantly been plummeting below DMAs.

Bulls test support exactly at double top neckline, but shooting star signals weakness, one can expect more dips on a breach below the neckline (refer daily charts).

But from the last couple of days, bulls have managed to test support at neckline on dailies and hovering at 23.6% Fibonacci levels on monthly plotting.

On a broader perspective, consolidation phase in major trend goes in the range bounded pattern, while shooting stars signal weakness at the range resistance.

Although GBPJPY began this week with minor spikes, halted bull swings below 21DMA levels from yesterday as the shooting star pattern has popped up again (daily chart).

In the recent history, shooting stars at the stiff resistance of 147.789 have evidenced price slumps upto the current 145.085 levels. For now, the range bounded trend seems to be on cards as the both leading and lagging oscillators have been indecisive on daily plotting.

Most notably, if the prices slumps extend further below 139 levels, then potentially, the major downtrend likely to resume again.

From last two months, bearish sentiments so far have taken the pair below 21EMA levels, we foresee southward journey upto next strong support at 139.243 levels.

Please be noted that stochastic oscillator has been indecisive on daily terms. While RSI has shown losing strength in bullish sentiments at 51 levels (monthly chart).

MACD on the other hand signals indecisiveness on both daily and monthly terms.

Trade tips:

Contemplating above technical rationale, on trading perspective, it is advisable to buy leveraged instruments such as binary options that are the most suitable for intraday trading. At spot ref: 140.880 (while articulating) we advocate boundary binary strategy for intraday speculators in an on-going puzzling environment. Use upper strikes at 141.470 and lower strike at 139.987. The strategy is likely to fetch leveraged yields as long as the underlying spot rate remains between upper and lower strikes.

For the investment to pay off, the price of the underlying asset only needs to remain between strike prices on expiration. The payout would vary greatly depending on how far away is the strike price and the time till expiration.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -6 levels (neutral), while hourly JPY spot index was at shy above -67 (bearish) at the time of articulating (at 06:06 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: