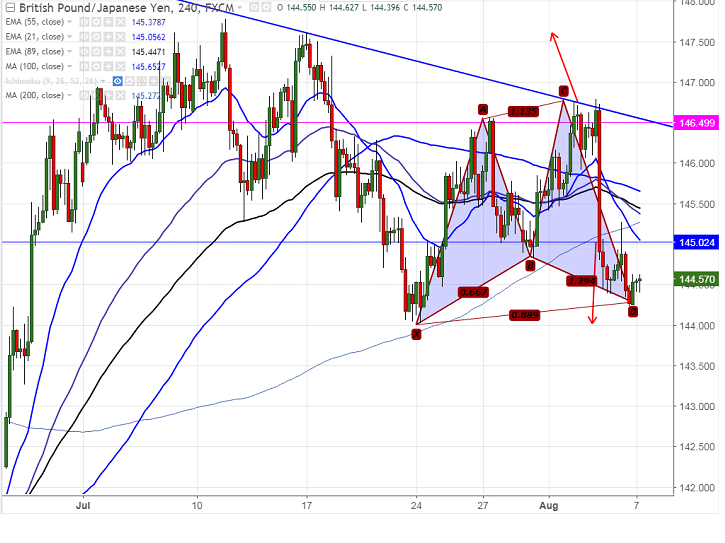

- Major support – 144.38 (55- day EMA).

- GBP/JPY formed a minor bottom around 144.38 yesterday and recovered slightly from that level. It has declined till 144.86.

- The pair is facing minor resistance around 145.35 (21- day EMA) and any break above will take the pair till 146.60/147.10.

- On the lower side, near term intraday support is around 144.38 and any break below will drag the pair down till and any break below 144.38 will drag the pair till 143/142.30.

It is good to sell on rallies around 145.25-30 with SL around 146.40 for the TP of 143/142.30.