- GBP/JPY declined sharply almost 300 pips previous week on account of weak GBP. Pound sterling was trading weak against all majors in previous week on account of weak UK economic data.UK CPI , wage growth and retail sales data came below estimate. BOE Mark Carney told in interview that chance of rate hike in the month of May will be less.

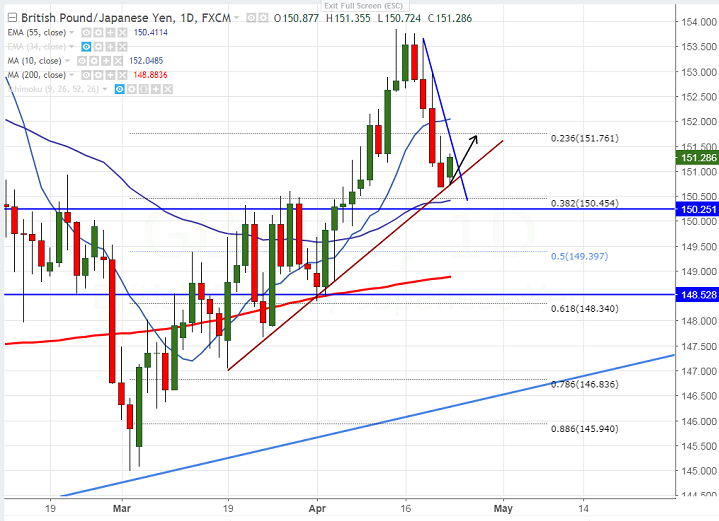

- The pair jumped almost more than 60 pips from the Friday’s low of 150.68 and is currently trading around 151.30.

- The major resistance is around 152 (10- day MA) and any convincing break above targets 152.80/153.85.

- On the lower side, near term support is around 150.37 (55- day EMA) and any close below will drag the pair till 150/149.39 (50% fibo).

It is good to buy on dips around 150.80-90 with SL around 150.37 for the TP of 152