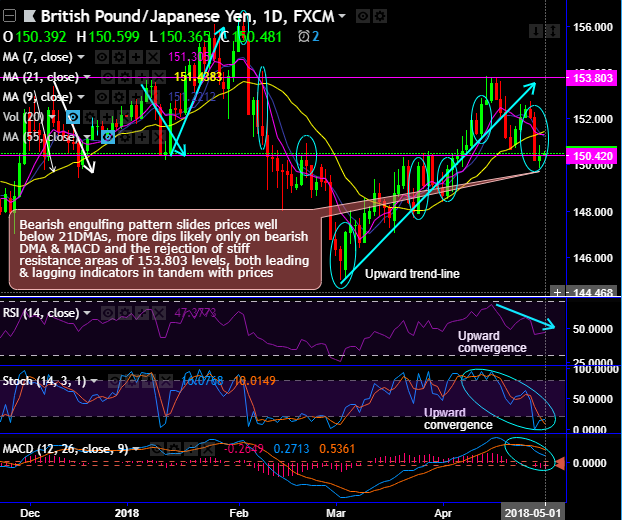

Chart and candlestick patterns occurred: The intermediate trend spikes through rising channel (refer weekly chart), while bearish engulfing pattern candle counters the bullish effects in the minor trend that evidences considerable slumps below DMAs (refer daily chart).

For now, the bulls have tested the strong support at channel baseline. Consequently, the rallies are extended upto the stiff resistance of 154.767 levels.

Engulfing pattern has occurred at 150.201 levels countering bullish swings after the rejection at the stiff resistance of 153.803 levels.

Both RSI and stochastic oscillator on both daily and weekly terms have been converging downwards that indicate strength and momentum in the selling sentiments.

While MACD on daily terms substantiates bearish interests, signals extension of price slumps.

Trade tips:

On speculative grounds, at spot reference: 150.478, we advocate buying boundary binary options choosing upper strikes at 153.3050 levels and lower strikes at 149.836 levels.

Alternatively, one can add shorts in futures contracts of mid-month tenors with a view to arresting potential downside risks.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -143 (which is bearish), while hourly JPY spot index was at 36 (bullish), while articulating (at 06:17 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: