- GBP/JPY recovered sharply after better than expected UK Manufacturing PMI data. UK manufacturing PMI came at 56.9 compared forecast of 55.0.

- The pair jumped sharply from the low of 142.10 till 142.36 at the time of writing. Short term trend is slightly weak as long as resistance 143.20 holds.

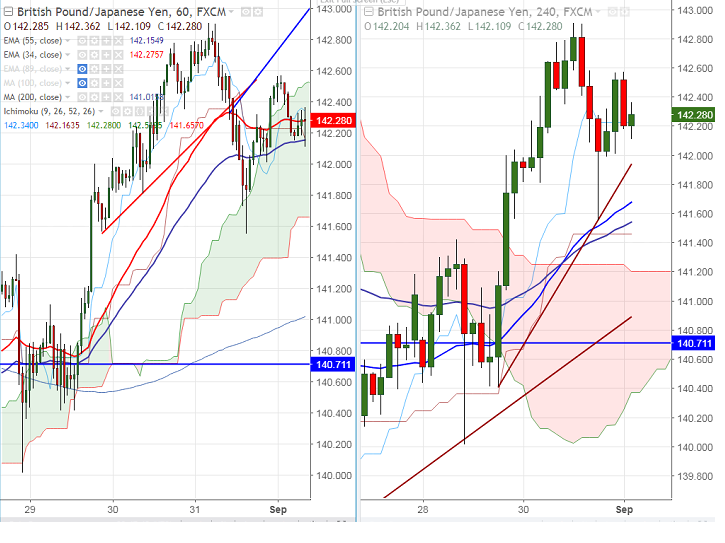

- On the lower side, major support is around 141.40. Any break below 141.40 will drag the pair till 141 (200- H MA)/140. Minor bearish continuation only below 139.30 level.

- The near term resistance is around 142.65 (34- day EMA) and any break above will take the pair till 143.20/144.

It is good to sell on rallies around 142.35-142.40 with SL around 143.20 for the TP of 141/140.