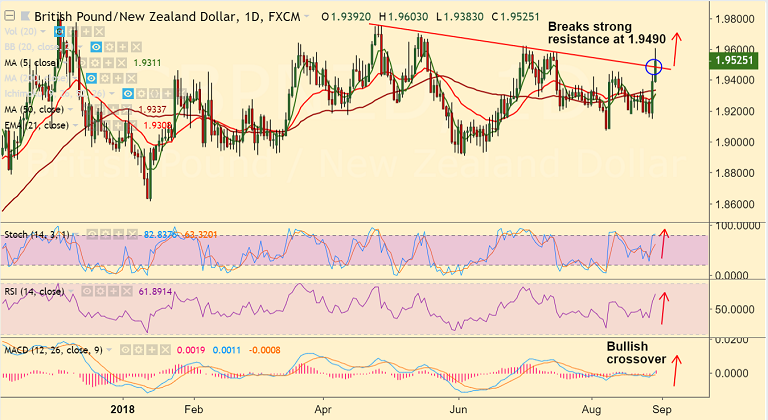

GBP/NZD chart on Trading View used for analysis

FxWirePro Currency Strength Index for GBP/NZD: Bias Bullish

FxWirePro's Hourly GBP Spot Index was at 103.87 (Bullish)

FxWirePro's Hourly NZD Spot Index was at -164.153 (Bearish)

Technical Analysis: Bias Bullish

- Momentum studies bullish. RSI above 50 levels, bias higehr

- MACD shows bullish crossover, +ve DMI crossover on -ve DMI seen

- Price action has broken above daily cloud

- Price breaks strong trendline resistance at 1.9490

Fundamental Views:

- Kiwi offered across the board in response to dismal NZ business confidence reading.

- The ANZ business confidence reading fell to -50.3 in August from the previous month's print of -44.9.

- Upbeat momentum in the sterling was triggered on comments from the European Union’s chief Brexit negotiator Michel Barnier.

- Barnier said the bloc was prepared to offer Britain an unprecedentedly close relationship after it quits the EU.

Support levels - 1.9338 (50-DMA), 1.9314 (5-DMA), 1.9255 (200-DMA)

Resistance levels - 1.9739 (200W SMA), 1.9838 (Nov 2017 high)

Recommendation: Good to go long on dips, SL: 1.9320, TP: 1.96/ 1.9735

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro: GBP/NZD Trade Idea

Thursday, August 30, 2018 12:08 PM UTC

Editor's Picks

- Market Data

Most Popular