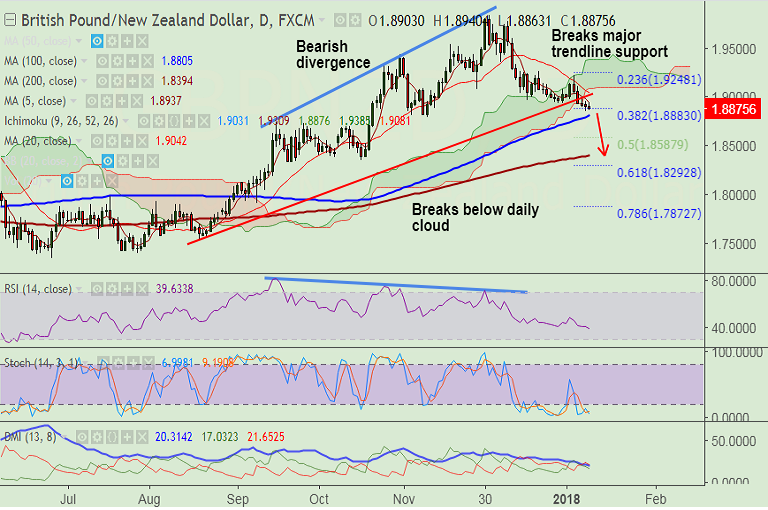

- GBP/NZD has shown a decisive break below major trendline support at 1.8975, bias lower.

- Price action has dipped below daily Ichimoku cloud and RSI and Stochs support further weakness.

- 5-DMA is sharply lower and caps upside attempts in the pair. Break above could see upside till 20-DMA at 1.9041.

- Next bear target lies at 1.8805 (100-DMA). Violation there will see further downside.

- Scope then for test of 50% Fib retrace of 1.73375 to 1.98383 rally at 1.8587.

Support levels - 1.8804 (100-DMA), 1.8587 (50% Fib retrace of 1.73375 to 1.98383 rally), 1.8394 (200-DMA)

Resistance levels - 1.8933(5-DMA), 1.9041 (20-DMA), 1.9214 (Jan 3rd high)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-GBP-NZD-rejected-at-50-DMA-slips-below-5-DMA-bias-lower-1081120) has hit TP1/2.

Recommendation: Book partial profits, trail stop loss to 1.90, hold for downside.

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at -34.0524 (Neutral), while Hourly NZD Spot Index was at 126.213 (Bullish) at 0740 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest