• GBP/NZD fell towards 2.1000 as stronger kiwi dollar, upbeat US economic data and diverging U.S.-UK rate expectations weighed on sterling.

•US second-estimate Q2 GDP growth came in at 3.0% versus 2.8% expected while initial jobless claims were 231k in the latest week, below the 232k forecast

• Traders will turn their attention next to Friday's release of the PCE inflation report, the Federal Reserve's preferred measure of price growth for clues about the pace of upcoming rate cuts.

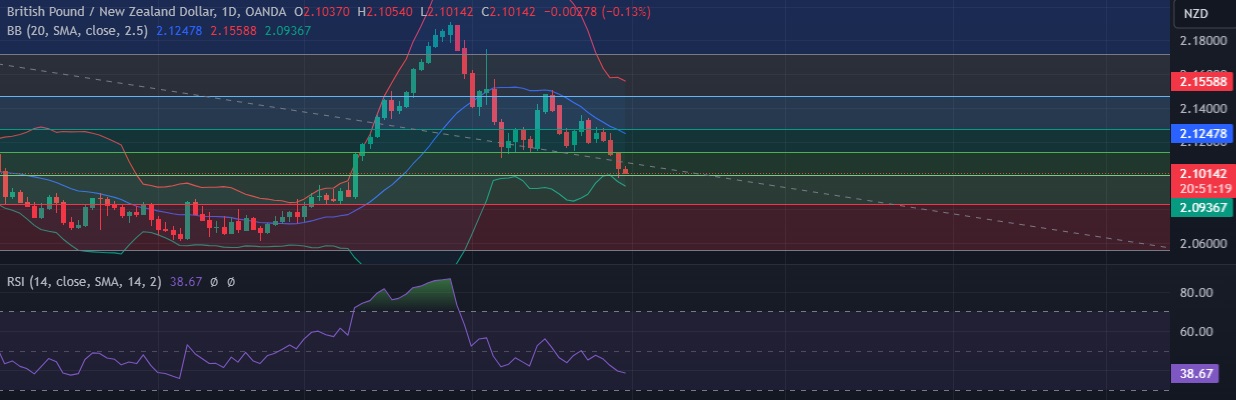

• Technicals are favouring bearish sentiment as RSI is at 38and the pair is trading below 5,10 & 11-DMAs.

• Immediate resistance is located at 2.1136(38.2% fib), any close above will push the pair towards 2.1200 (Psychological level)

• Strong support is seen at 2.1000(38.2% fib)and break below could take the pair towards 2.0940 (Lower BB).

Recommendation: Good to sell around 2.1040, with stop loss of 2.1100 and target price of 2.0940