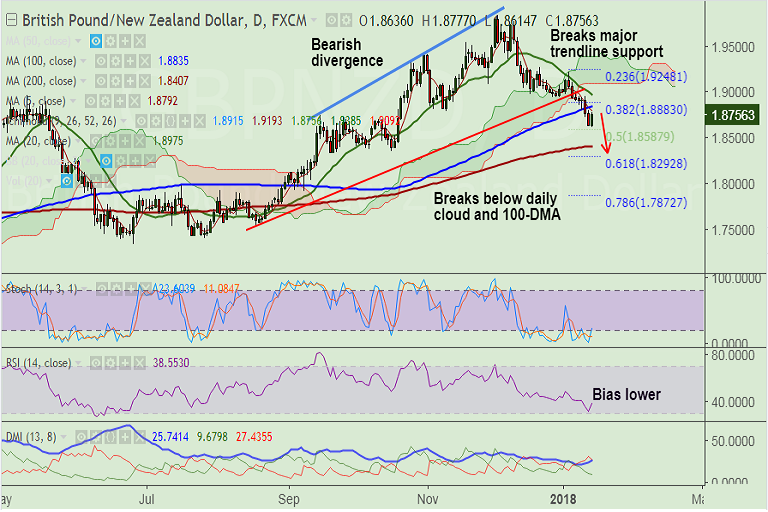

- GBP/NZD has shown a decisive break below 100-DMA, bears now target 200-DMA at 1.8407.

- Downside is currently holding above 50% Fib retrace of 1.73375 to 1.98383 rally at 1.8587.

- Break below to see further drag. Violation at 200-DMA will see further downside.

- Price action has dipped below daily Ichimoku cloud and RSI and Stochs support further weakness.

- 5-DMA is sharply lower and caps upside attempts in the pair. Break above could see upside till 20-DMA at 1.8975.

Support levels - 1.8587 (50% Fib retrace of 1.73375 to 1.98383 rally), 1.8407 (200-DMA), 1.8292 (61.8% Fib)

Resistance levels - 1.8793 (5-DMA), 1.8835 (100-DMA), 1.8830 (30% Fib)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-GBP-NZD-rejected-at-50-DMA-slips-below-5-DMA-bias-lower-1081120) has hit all targets.

Recommendation: Watch out for break below 50% Fib for further downside.

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at 23.3838 (Neutral), while Hourly NZD Spot Index was at 66.9709 (Neutral) at 1040 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest