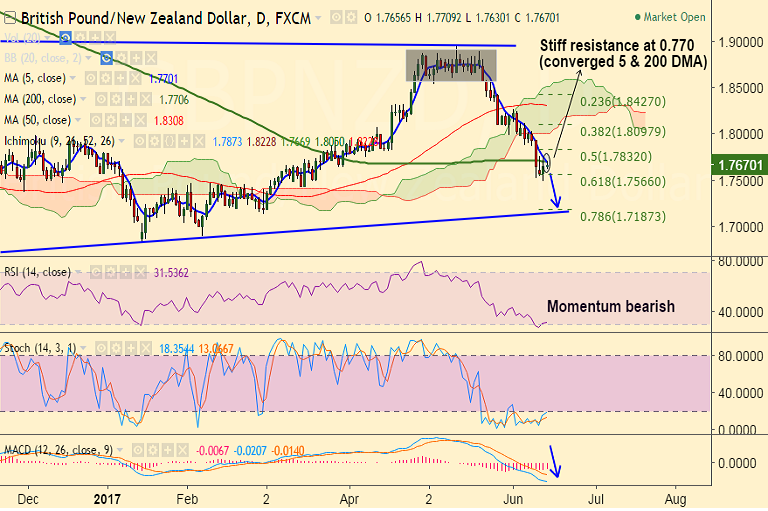

- GBP/NZD trades a narrow range, upside rejected around 200-DMA at 1.7706.

- The pair was extending previous session's gains, but recovery lacks traction.

- Major resistance seen at 0.770 (converged 5 & 200 DMA), further upside only on break above.

- Ichi cloud weighs on the upside on weekly charts, momentum studies biased lower.

- Selling pressure around the Pound has exacerbated following election results, we see scope for test of major trendline support at 1.7140.

- On the daily charts, the pair has failed to hold break above 200-DMA on Monday's trade.

- Upside remains capped below 5-DMA at 1.7747, we see bearish invalidation only on close above.

Support levels - 1.7433 (Mar 15, 16 low), 1.7187 (78.6% Fib of 1.6705 to 1.8959 rise), 1.7140 (Trendline & Mar 1 low)

Resistance levels - 1.770 (converged 5 & 200-DMA), 1.78, 1.7832 (50% Fib)

Call update: We had advised a short call (http://www.econotimes.com/FxWirePro-GBP-NZD-fails-to-hold-break-above-200-DMA-good-to-short-rallies-752096). TP 1 hit.

Recommendation: Hold for further downside.

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at -181.696 (Bearish), while Hourly NZD Spot Index was at 98.6831 (Bullish) at 0940 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.