• GBP/NZD retreated on Monday as the pair rise faded as investors reassessed their expectations for the UK economy and interest rates.

• GBP/NZD has been consolidating of late, partly on optimism that BoE increase rates.

• Currently, the 2.0594 (38.2% fib) barrier is restricting lower move, will likely be a speed bump to bears.

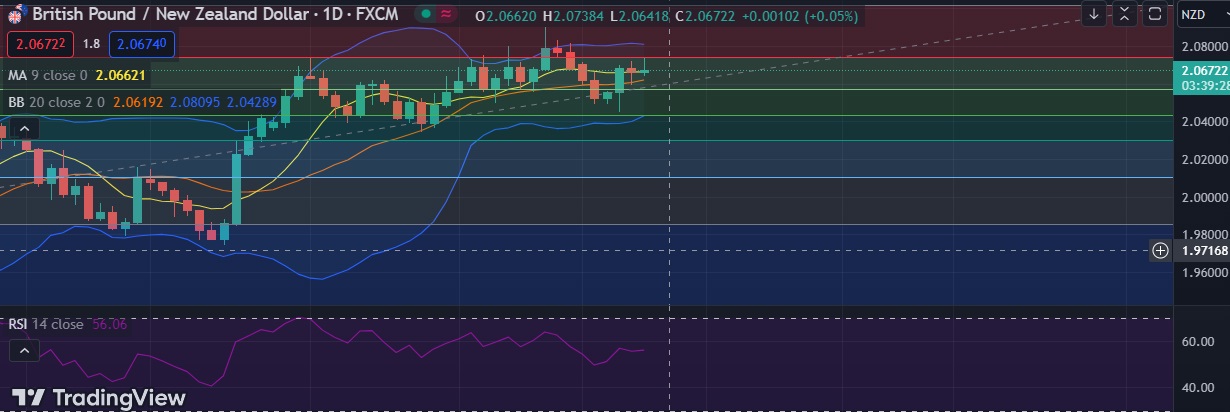

• Technical signals are bullish as RSI is at 56, daily momentum studies 5, 9 and 10 DMAs are trending north.

• Immediate resistance is located at 2.0744 (23.6% fib), any close above will push the pair towards 2.0814 (Higher BB).

• Strong support is seen at 2.0594 (38.2% fib) and break below could take the pair towards 2.0493(July 5th low).

Recommendation: Good to buy on dips around 2.0640, with stop loss of 2.0600 and target price of 2.0760.