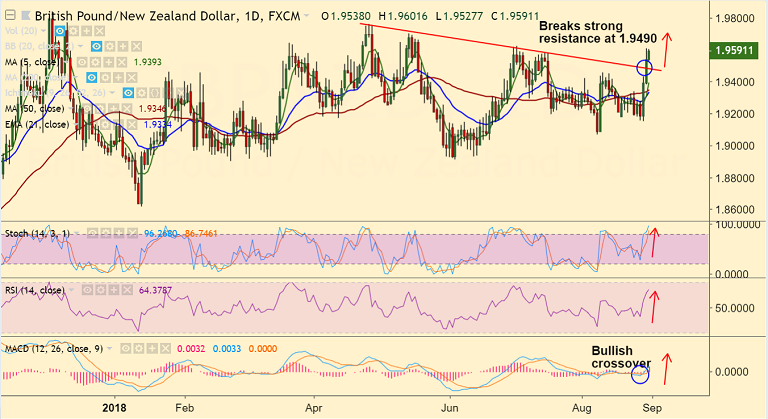

GBP/NZD chart on Trading View used for analysis

- GBP/NZD is extending gains after break above major trendline resistance at 1.9490.

- Upside has paused at 1.96 handle, bias bullish, break above will see further gains.

- Kiwi remains weak after dismal NZ business confidence reading on Wednesday.

- Further, escalating US-China trade tensions and Italy's fiscal concerns to keep sentiment depressed, weighing further on the kiwi dollar.

- Technical analysis shows bullish bias for the pair. Momentum studies bullish. RSI above 50 levels, bias higher.

- MACD shows bullish crossover and +ve DMI crossover seen on -ve DMI. Price action has broken above daily cloud and major trendline resistance at 1.9490.

- We see scope for test of 200W SMA at 1.9739, breakout there could see further upside.

Support levels - 1.9393 (5-DMA), 1.9346 (50-DMA), 1.9334 (21-EMA)

Resistance levels - 1.96/ 1.97/ 1.9739 (200W SMA), 1.9838 (Nov 2017 high)

Recommendation: Good to go long on dips, SL: 1.9320, TP: 1.96/ 1.9735

Call update: Our previous call (https://www.econotimes.com/FxWirePro-GBP-NZD-Trade-Idea-1422077) has hit TP1.

Recommendation: Book partial profits at highs. Watch out for break above 1.96 for further upside.

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at 59.6676 (Neutral), while Hourly NZD Spot Index was at -81.4353 (Bearish) at 0645 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.