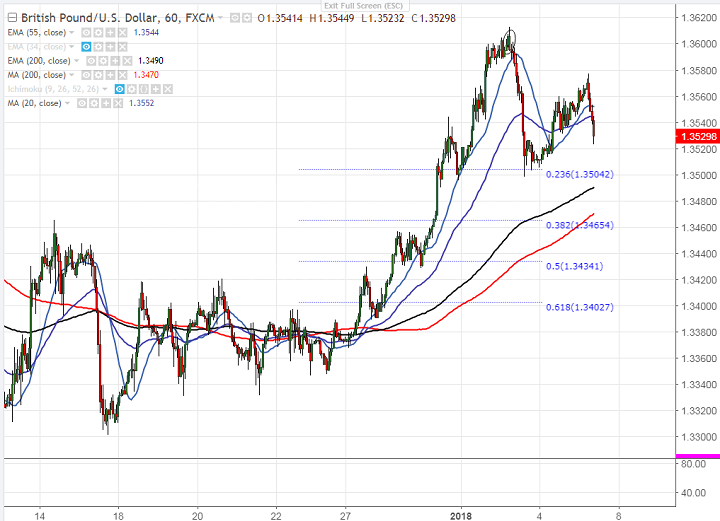

- Cable has shown a minor jump from the low of 1.34980 on Jan 3rd 2018. The pair jumped 90 pips ans shown a minor selling from the high. It is currently trading around 1.35230.

- Pound sterling was trading weak this week after hitting high of 1.6125 on account of slightly weaker than UK PMI data. But further movement in this pair depends on US non-farm payroll data to be released today. The wage growth is main factor to be considered and any better than expected wage growth will make the dollar stronger.

- On the lower side, near term support is around 1.347 (200- H MA) and any break below will drag the pair to next level till 1.3430/1.34020 (61.8% retracement). Short term bullish invalidation only below 1.3330.

- The near term resistance is around 1.3600 and any break above will take the pair to next level till 1.3655/1.3700. Bullish continuation only above 1.3650.

It is good to sell on rallies around 1.3575-80 with SL around 1.3630 for the TP of 1.3500/1.3460.

.