The whole world knows the intensity of the bearish trend of GBPUSD (tumbled more than 25% in just 2 and odd years).

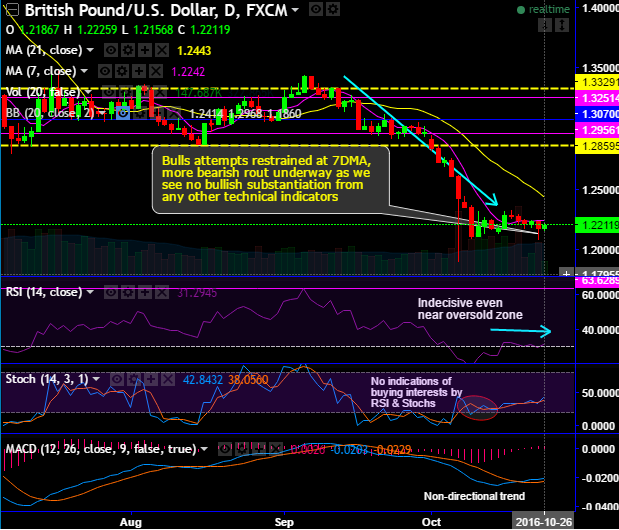

Amid this major trend, the interim bulls attempt to jump but restrained at 7DMA (see daily charts), more bearish rout underway as we see no bullish substantiation from any other technical indicators.

But in last two-three weeks, the attempts of bull-swings take the short term trend in sideways.

As and when you see the price jump, bears resume and have been attempting to slide again below 7DMMA from the last couple of days on daily charts.

Today again day highs haven’t been able to push further and are stuck at 1.2225 levels. While leading indicators have been indecisive to these swings.

But RSI & Stoch are indicative of further dips on monthly charts, whereas RSI on daily terms has been indecisive (trending in the linear direction above 31 levels).

Slow stochastic on the other hand noises with the attempts of %D line cross over even below oversold region on monthly terms, which means that it alarms bears trying to take over the tight rallies.

On long-term perspectives, dipping prices, Massive volumes, leading & lagging indicators still signal weakness..! What else is required to confirm major downtrend?

While the current prices on this plotting are well below EMAs.

Monthly MACD’s bearish crossover continued to move below zero level which is bearish region.

Hence, contemplating above technical reasoning, although there are short-term buying opportunities, we would still foresee further GBP weakness in medium terms.

Trade tips:

Intraday speculators can eye on boundary binaries keeping 1.2260 upper bracket (45-50 pips) and 1.2108 as the lower bracket (90-100 pips).