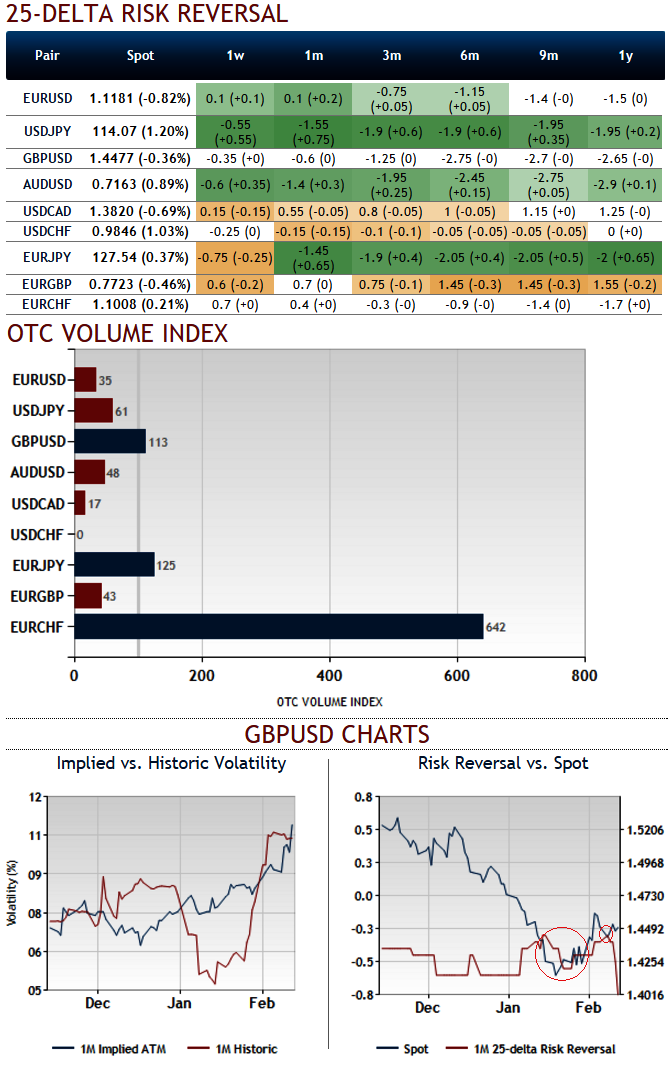

Please observe as to how the delta risk reversal numbers are getting higher negative values gradually in a long run (flashing at -2.65 for 1 year expiries). Volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

To justify this stance, see the OTC VIX for GBPUSD as we observe the volumes of standard contracts taking place in the over-the-counter (OTC) forex options market. This OTC volume index indicates total numbers of traded contracts in the past 24-hours versus a rolling one month daily average. Values over 100 indicate volume higher than the average, values under 100 indicate volume lower than the average.

Well, the pair in this case exceeds 100 which is the largest volumes among G10 currency segment.

As the risk reversals for 1W-1M expiries also indicate that the puts have been relatively expensive and as stated above traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

The challenge now is determining which strikes you should use in this strategy. The broader the strike difference between short and long puts, the fewer puts you need to sell to cover the price of the long puts. But at the same time, the coverage of long-to-short is going to be more difficult in the event of assignment.

The current spot FX is trading at 1.4422, we anticipate more dips extending up to 1.4229 levels in near terms. And it is understood that bearish momentum is bolstering as we saw that from delta risk reversal table, bears have been willing to pay higher premiums. Hence, aggressive bears can initiate strategy using ATM puts.

Considering historical evidences, OTC volumes index and further bearish risk reversal arrangements, spot FX of GBPUSD is likely to converge the bearish targets.

FxWirePro: GBP/USD risk reversal still favors bears, convergence between spot and risk reversals likely

Tuesday, February 16, 2016 7:05 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?