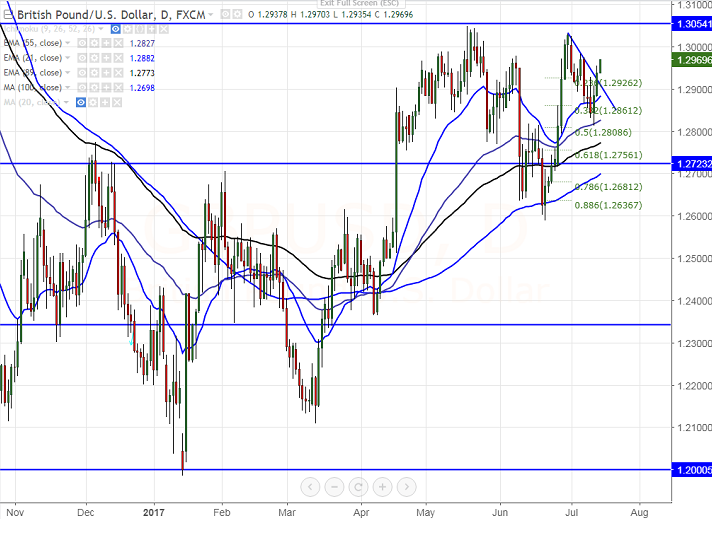

- Cable has recovered sharply after hitting low of 1.28118 level on Jul 12th 2017. The pair has taken support near daily Kijun-Sen and jumped from that level.

- The pair broken minor resistance of 1.2925 and jumped till 1.2970. Market awaits U.S CPI data for further direction. Any weakness in U.S CPI will take the cable till 1.30475/1.3100.

- It has formed minor resistance around at 1.3030 in the previous week and any break above targets 1.3050. Any bullish continuation can be seen only above 1.31000.

- On the lower side, near term support is around 1.2918 (daily Tenkan-Sen) and any break above 1.2870 (21- EMA)/1.2820 (55- EMA).It should break below daily Kijun-Sen at 1.2810 for further bearishness.

It is good to buy on dips 1.2935-40 with SL around 1.2870 for the TP of 1.3000/1.3030