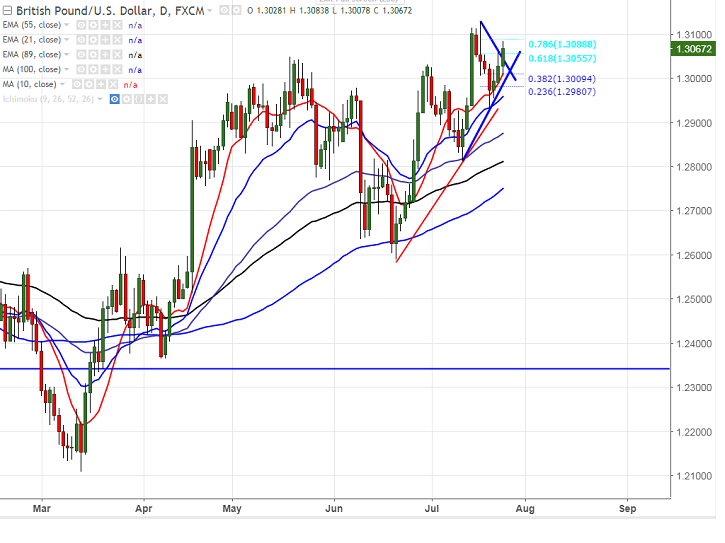

- Cable is trading stable in Tuesday morning and broken minor resistance 1.30618 on account of weak U.S dollar. The pair jumped till 1.30838 at the time of writing. It is currently trading around 1.30633.

- Market awaits US Fed monetary policy meeting on Wed and U.K Q2 preliminary GDP for further direction.

- On the higher side, the pair is facing major resistance around 1.3130 and any break above confirms bullish continuation. Any break above will take the pair till 1.3200/1.3250 (161.8% retracement of 1.31262 and 1.29328).

- On the lower side, near term support is around 1.2988 (10- day MA) and any break below will drag the pair till 1.2930 (21- EMA)/ 1.2857 (daily Kijun-Sen)/1.28118 (Jul 12th low).

It is good to buy on dips around 1.30300 with SL around 1.2988 for the TP of 1.3130/1.3200.