- Cable slides today after recovering till 1.35127 at the time of writing. The pair weakness was mainly due to political scandal and Brexit talks. The pair has formed temporary bottom around 1.30280 and further weakness below that level.

- The pair is trading sideways and sixth round of Brexit negotiations is happening in Brussels from Nov 9th and market will be looking for progress for further movement in pound.

- US-UK 10 year bond yield on rise after dovish comment by BOE. UK 10 year gilts yields declined almost 200 basis point after the BOE monetary policy meeting.

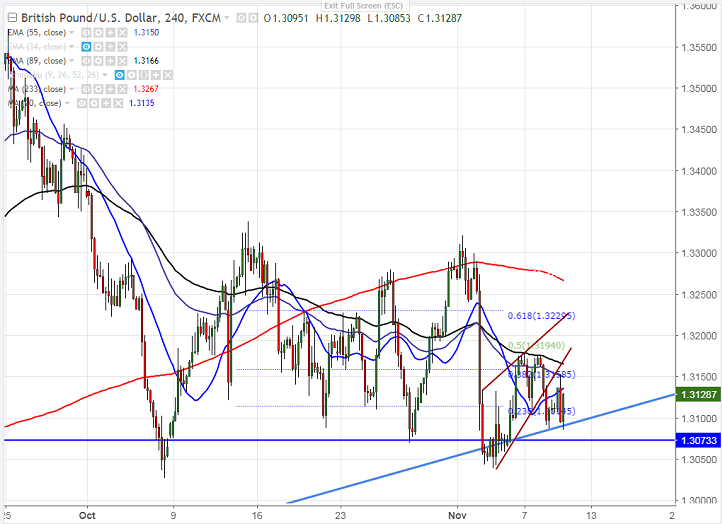

- The pair has formed bearish flag pattern in the 4 hour chart and any minor bullishness can be seen only above 1.3210. The near term resistance is around 1.3180. Any short term bullish continuation only above 1.3380.

- On the lower side, near term major support is around 1.3100 and any violation below will drag the pair down till 1.30380/1.30270.

It is good to sell on rallies around 1.3165-70 with SL around 1.3210 for the TP of 1.30280.