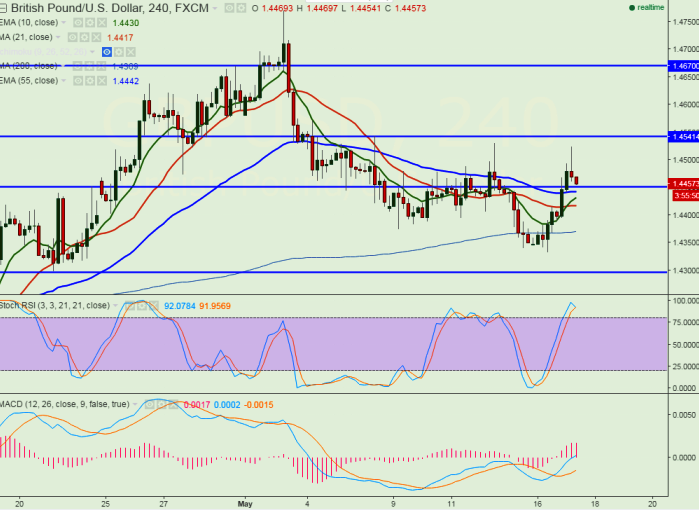

- Major Resistance – 1.4550

- Major support- 1.4445 (55 day 4H EMA)

- Cable has retreated from high of 1.45239 after softer CPI data. It is currently trading around 1.4470 level.

- UK CPI came at 0.3% y/y compared to forecast of 0.5% Y/Y.

- Short term trend is bearish as long as resistance 1.4550 holds.

- Any indicative break above 1.4550 will take the pair to next level till 1.4600/1.4660.The minor resistance is at 1.4530

- On the lower side any break below 1.4450 will drag the pair till 1.4400/1.43250 level.

It is good sell on rallies around 1.4465-1.4470 with SL around 1.4530 for the TP of 1.4360/1.4325