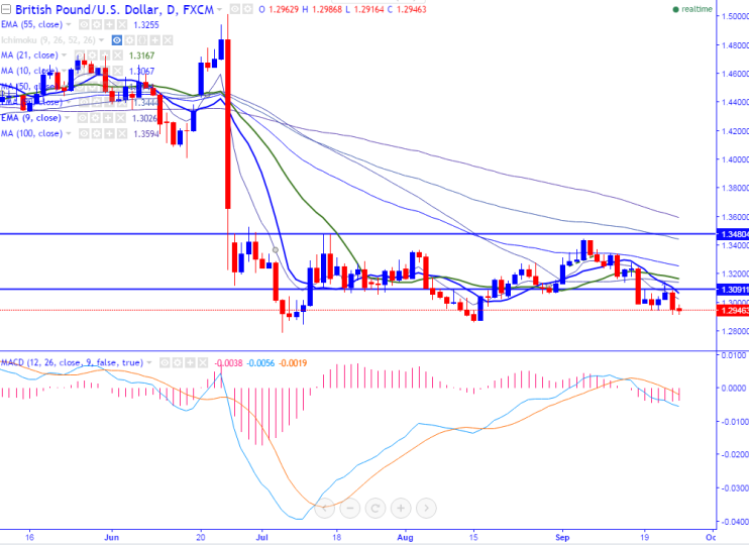

- Major resistance- 1.2998 (5- day MA).

- Major intraday support – 1.2900.

- Cable has recovered sharply from the low of 1.2149 made on Friday. It is currently trading around 1.29388.

- On the higher side, major resistance is around 1.3000 (5- day MA)and any break above will take the pair to next level till 1.3053 (7- day EMA)/ 1.3106 (10- day MA).

- In the daily chart, the pair is trading well below 10-day MA and 5-day MA.Short term bullishness only above 1.3100.

- Cable’s support stands at 1.2900 and any violation below will drag the pair down till 1.2865/1.2820.

It is good to sell on rallies around 1.2980-85 with SL around 1.3055 for the TP of 1.2900/1.2865.