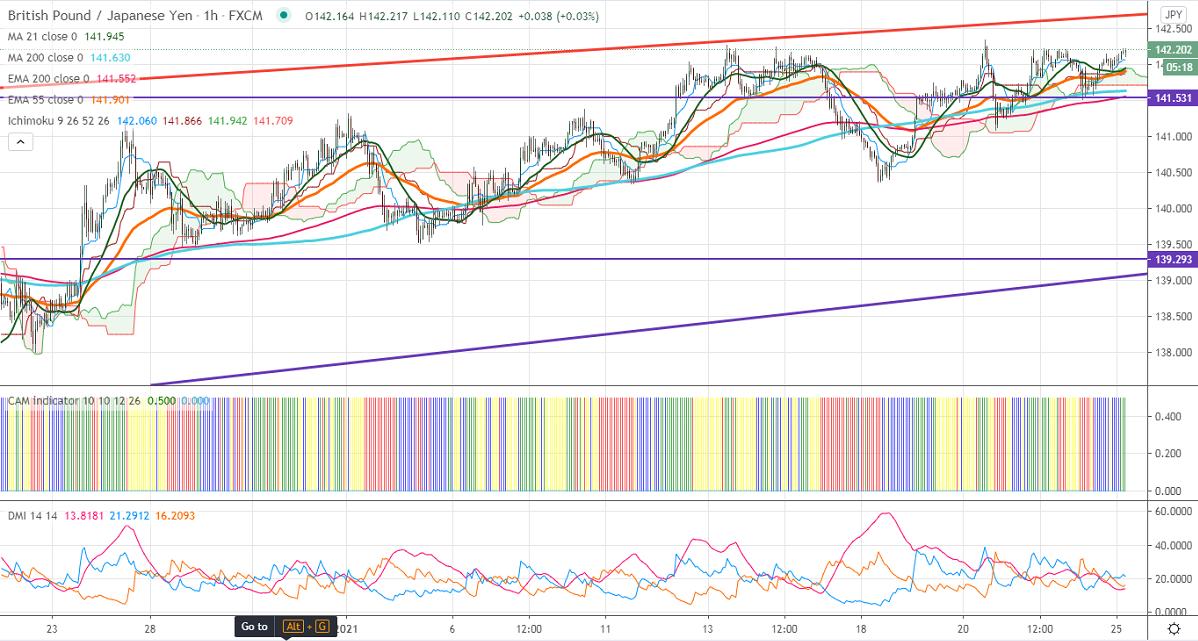

Ichimoku Analysis (1-hour Chart)

Tenken-Sen- 142.06

Kijun-Sen- 141.866

GBPJPY has shown a minor decline below 55-day EMA and recovered more than 100 pips. Any convincing break above 142.25 confirms a bullish continuation. The Intraday trend is bullish as long as support 141 holds. The Pound sterling jumped more than 60 pips against the USD on broad-based US dollar selling.

Technical:

The pair's significant resistance at 142.25-30, any convincing break above targets 142.70. Primary trend continuation only if it goes past 142.70.A jump till 144/145 likely. On the lower side, near term support is around 141.70, and any violation below targets 141/140.35.

It is good to buy on dips around 141.50 with SL around 141 for the TP of 142.70/144.