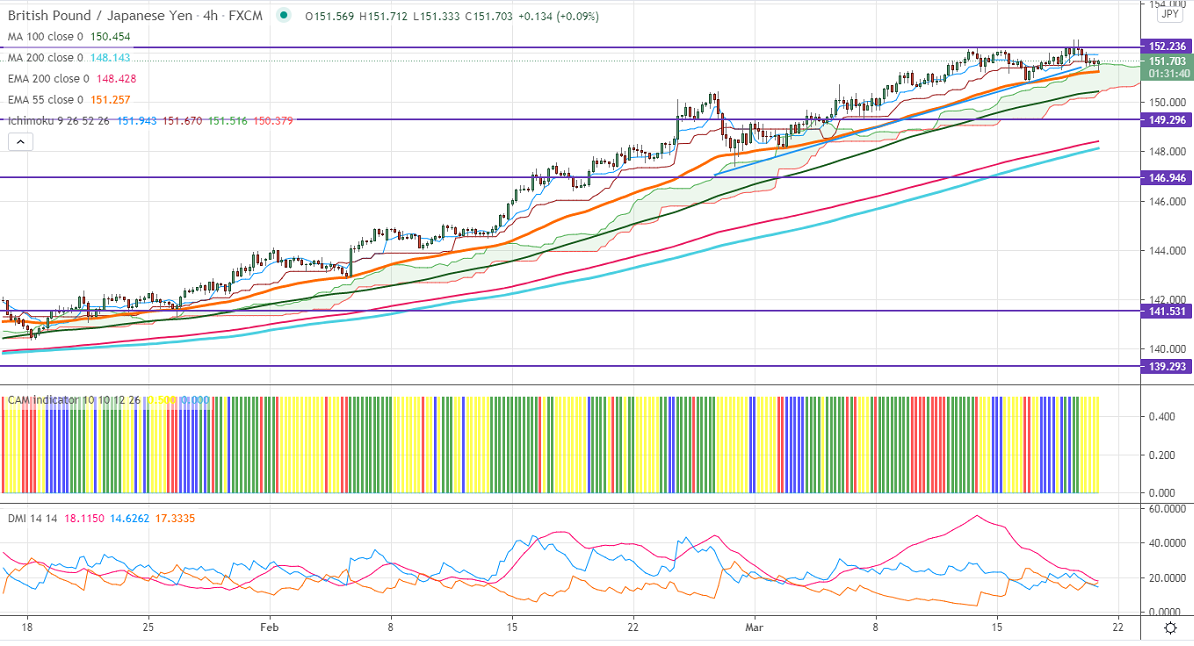

Ichimoku Analysis (Hourly Chart)

Tenken-Sen- 151.94

Kijun-Sen- 151.67

GBPJPY has once declined after a minor jump above 152 level on strong yen. The Bank of Japan has widened its yield target band and said that it would buy ETF only whenever necessary. USDJPY is consolidating after policy; any break below 108.60 confirms intraday weakness. The intraday trend of GBPJPY is bearish as long as resistance152.55 holds.

The Bank of England has kept its rates and bond-buying program unchanged as expected. It ha said that the central bank is not worried about rising bond yield.

Technical:

The pair's near-term resistance around 152.60, any break above targets 152.90/ 153.50/154/154.40. On the lower side, near-term support is around 151.20. An indicative violation below will drag the pair down to 150.50/150. Significant trend reversal only below 149.35.

Ichimoku Analysis- The pair is trading above Tenken-Sen, Kijun-Sen, and Ichimoku cloud. This confirms intraday bearishness.

Indicator (Hourly chart)

CAM indicator –Neutral

Directional movement index –Neutral

It is good to sell on rallies around 152.20-25 with SL around 153 for the TP of 150.