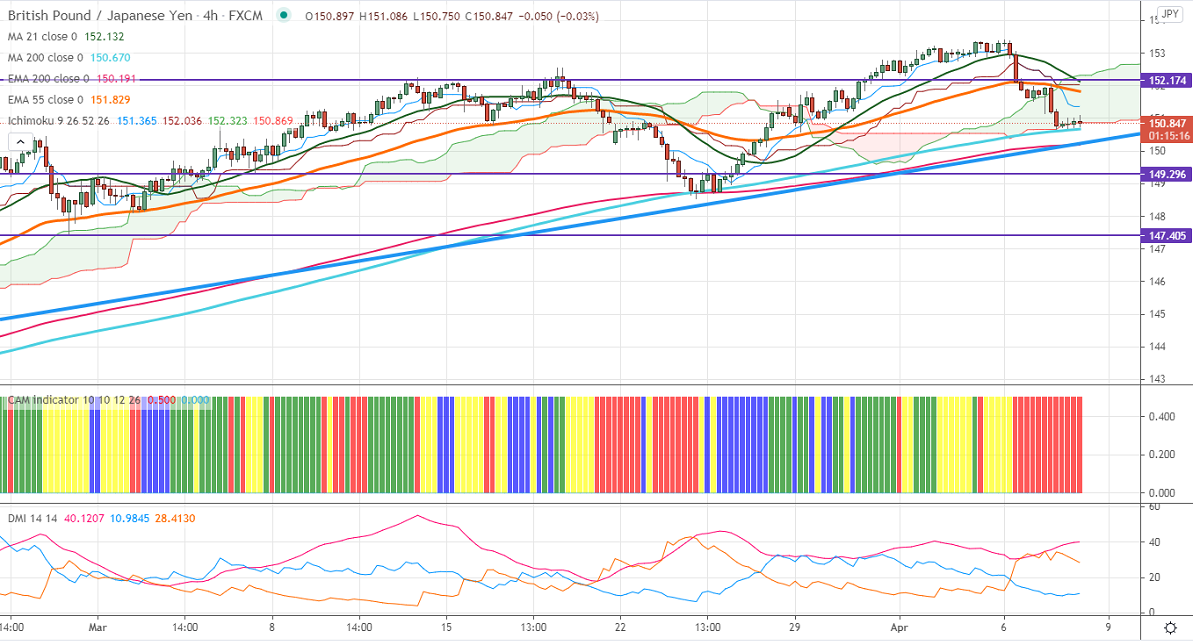

Ichimoku Analysis (Hourly Chart)

Tenken-Sen- 151.36

Kijun-Sen- 152.03

GBPJPY continues to trade lower for third consecutive days and lost more than 250 pips on pound sterling weakness. GBPUSD is trading weak after UK authorities said the risk of blood clots due to the AstraZeneca vaccine is higher under the age of 30. The UK Markit services PMI came in at 56.30 for Mar compared to an estimate of 56.8. USDJPY is still in bearish mode and holding below 110 on a slight increase in demand for safe-haven assets. The intraday trend of GBPJPY is bearish as long as resistance 151.20 holds.

Technical:

The pair's near-term resistance around 151.40, any break above targets 152/152.35/153. On the lower side, near-term support is around 150.65. Any indicative violation below that level will drag the pair down to 150/149. Significant trend reversal only if it breaks below 148.50.

Ichimoku Analysis- The pair is trading well below 4-hour Kijun-Sen, Kijun-Sen, and cloud. Any break below 152.25 confirms intraday bullishness.

Indicator (4-Hour chart)

CAM indicator –Bearish

Directional movement index –Bearish

It is good to sell on rallies around 151.45-50 with SL around 152 for TP of 150.