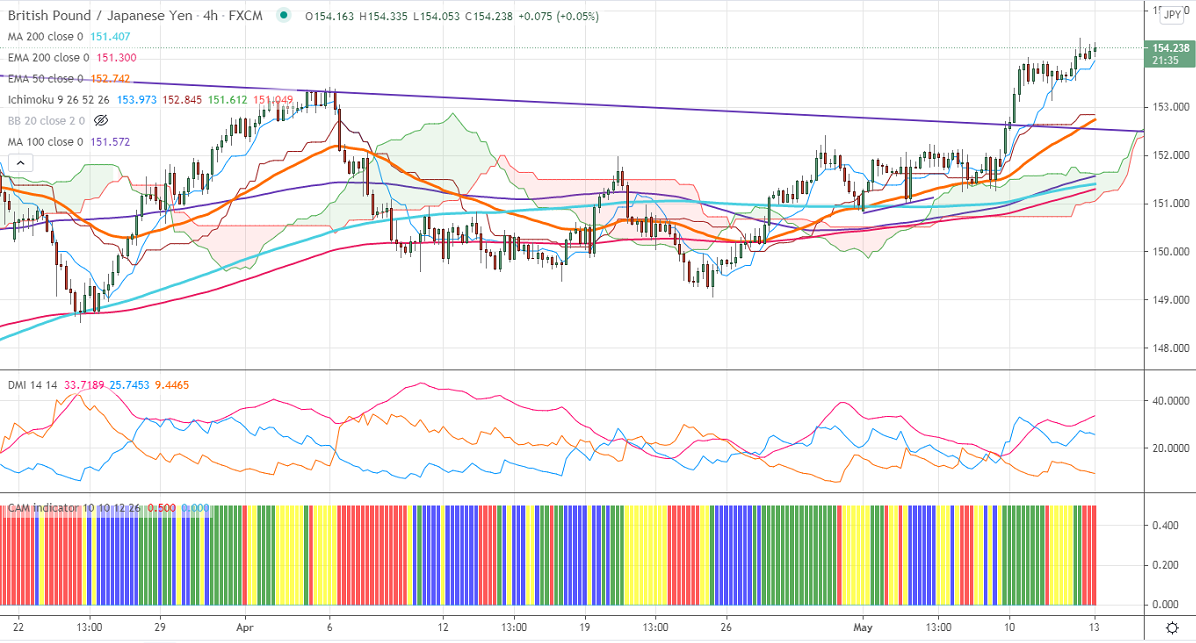

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 153.79

Kijun-Sen- 152.84

GBPJPY has halted its 14 days of bullish trend and trading flat with no buying momentum. The minor selling in Pound sterling due to recovery in the US dollar is putting pressure on this pair. GBPUSD lost more than 100 pips from minor top 1.41672. But the pair is holding well above 1.4000. Any breach below 1.4000 confirms bearish continuation. USDJPY surged nearly 150 pips due to a surge in US bond yield. The intraday trend of GBPJPY is bullish as long support 153 holds. Markets eye Bank of England governor speech for further direction.

Technical:

The pair's near-term resistance around 154.50, any break above will take the pair to next level till 155/156. On the lower side, near-term support is around 153.5 0. Any indicative violation below that level will drag the pair down to 152.80/152.30/152. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading above 4-hour Kijun-Sen and below Tenken-Sen, cloud.

Indicator (4-Hour chart)

CAM indicator –Bearish

Directional movement index –Bearish

It is good to buy on dips around 153.25-30 with SL around 152.80 for a TP of 155.