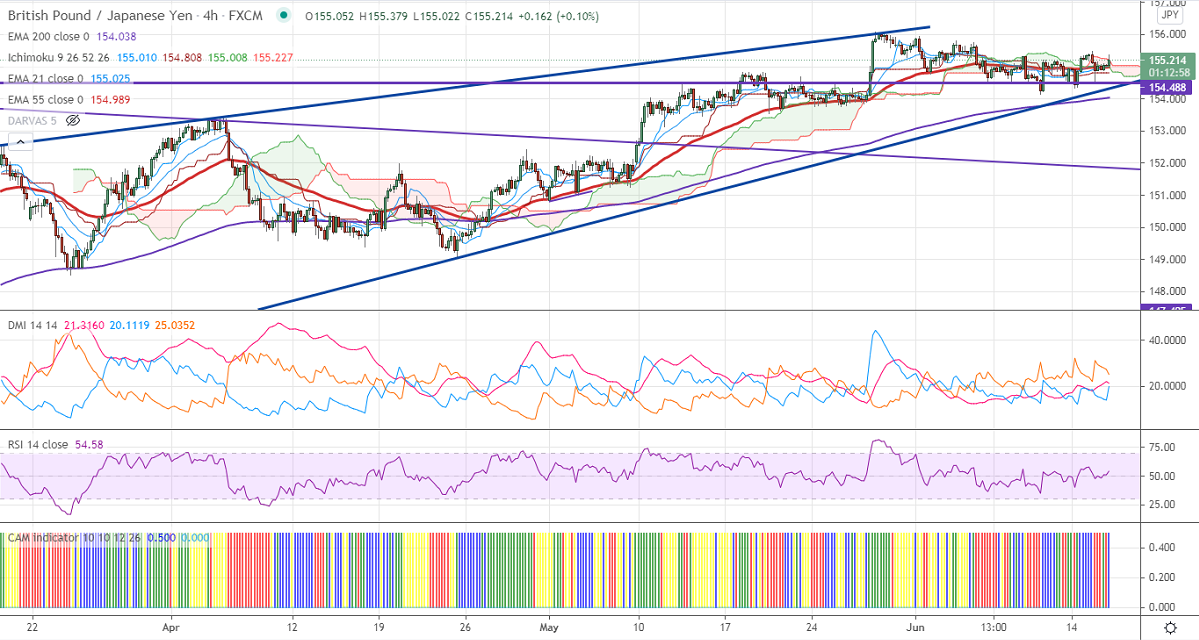

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 155.01

Kijun-Sen- 154.80

GBPJPY recovered slightly from yesterday's low of 154.53. The major jump in pound sterling is supporting the pair at lower levels. GBPUSD is holding above 1.4100 levels and delay in UK lockdown is preventing further upside. Markets eye UK CPI data which is to be released today for further direction. USDJPY has declined once again after a minor pullback above 110. Any breach above 110.35 confirms further bullishness. It hits an intraday high of 155.379 and is currently trading around 155.27.

Technical:

The pair's near-term resistance around 155.50 any break above confirms minor bullishness. A jump till 155.82/156.10/156.60 is possible. On the lower side, near-term support is around 154.50. Any indicative violation below that level will drag the pair down to 154.30/154/153.70/153. Significant trend reversal only if it breaks below 153.

Ichimoku Analysis- The pair is trading above 4- hour Kijun-Sen and above Tenken-Sen, cloud.

Indicator (4-Hour chart)

CAM indicator- Bearish

Directional movement index –Neutral

It is good to buy on dips around 154.55-60 with SL around 154 for a TP of 156.