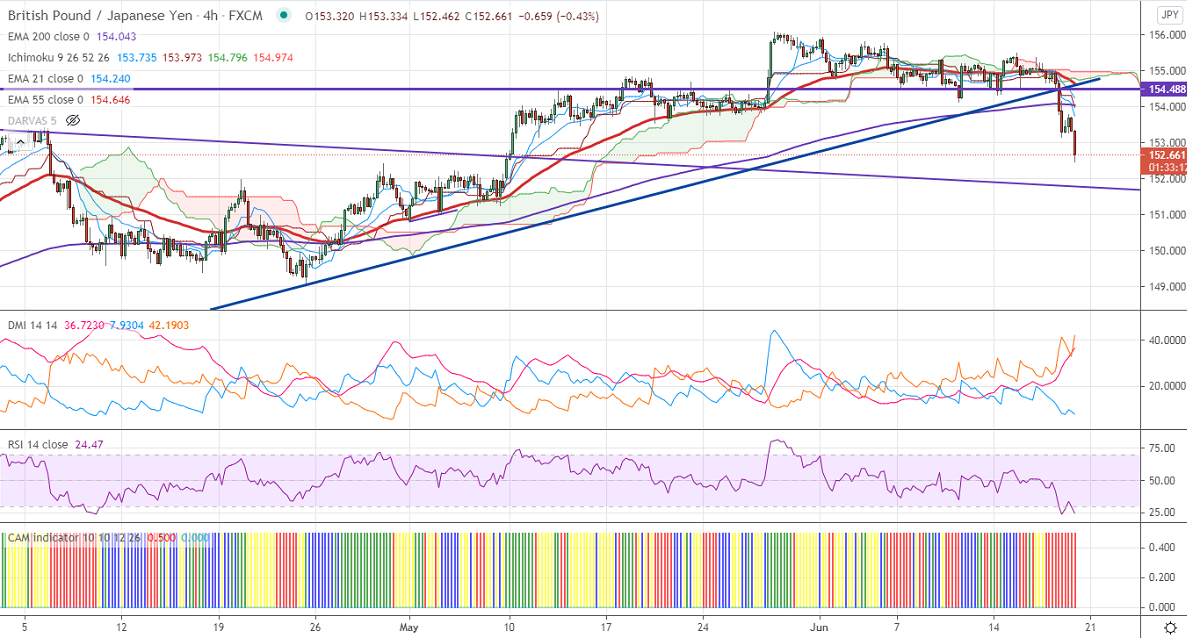

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 154.08

Kijun-Sen- 154.31

GBPJPY declined sharply yesterday and lost more than 150 pips on board-based pound sterling weakness. The Pound sterling is trading weak against the USD after the hawkish Fed. UK retail sales came at -1.4% in May compared to a forecast of 1.5%. The spread of the delta variant in the UK is delaying the reopening of lockdown. GBPUSD tumbled below 1.3900, a dip till 1.3800 is likely. USDJPY has declined after a minor top 110.82. Any breach above 111 confirms further bullishness. GBPJPY hits an intraday low of 152.46 and is currently trading around 152.56.

Technical:

The pair's near-term resistance around 153.30 any break above confirms intraday bullishness. A jump till 154/155/156 is possible. On the lower side, near-term support is around 152.30. Any indicative violation below that level will drag the pair down to 151.80/151/150. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading well below 4-hour Kijun-Sen, Tenken-Sen, cloud.

Indicator (4-Hour chart)

CAM indicator- Bearish

Directional movement index –Bearish

It is good to sell on rallies around 153 with SL around 153.70 for a TP of 150.80.