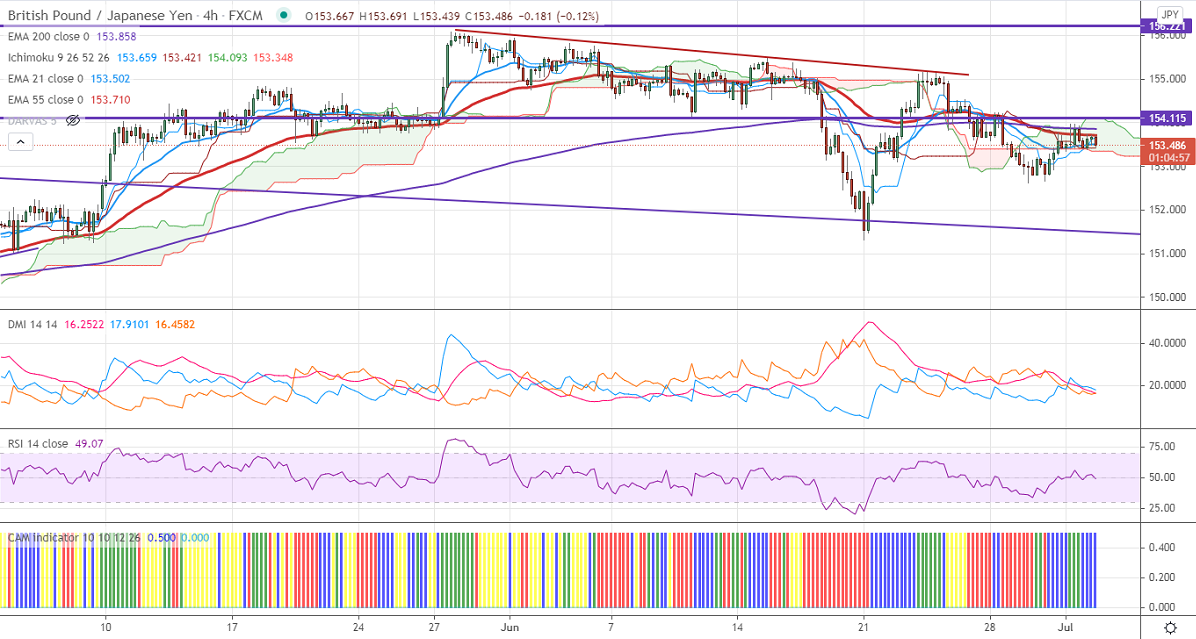

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 153.09

Kijun-Sen- 153.87

Yesterday's low – 153.39

This week high -154.22

GBPJPY has shown a minor decline from a high of 153.96 on board-based pound sterling selling. The weaker UK final manufacturing PMI and dovish BOE governor comments are dragging the Pound further down. GBPUSD's further movement depends on US Non-Farm payroll data. USDJPY is holding above 111, any breach above 112 confirms further bullishness. GBPJPY hits an intraday low of 153.43 and is currently trading around 153.49.

Technical:

The pair's near-term resistance around 154.22, any break above targets 154.60/155.15. Significant trend reversal only if it breaks 156.60. On the lower side, near-term support is around 153.40. Any indicative violation below that level will drag the pair down to 152.80/152.50/151.30. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading above Tenken-Sen and below Kijun-Sen.

Indicator (4-Hour chart)

CAM indicator- Slightly bullish

Directional movement index –Neutral

It is good to sell on rallies around 153.80-85 with SL around 154.25 for a TP of 151.30.