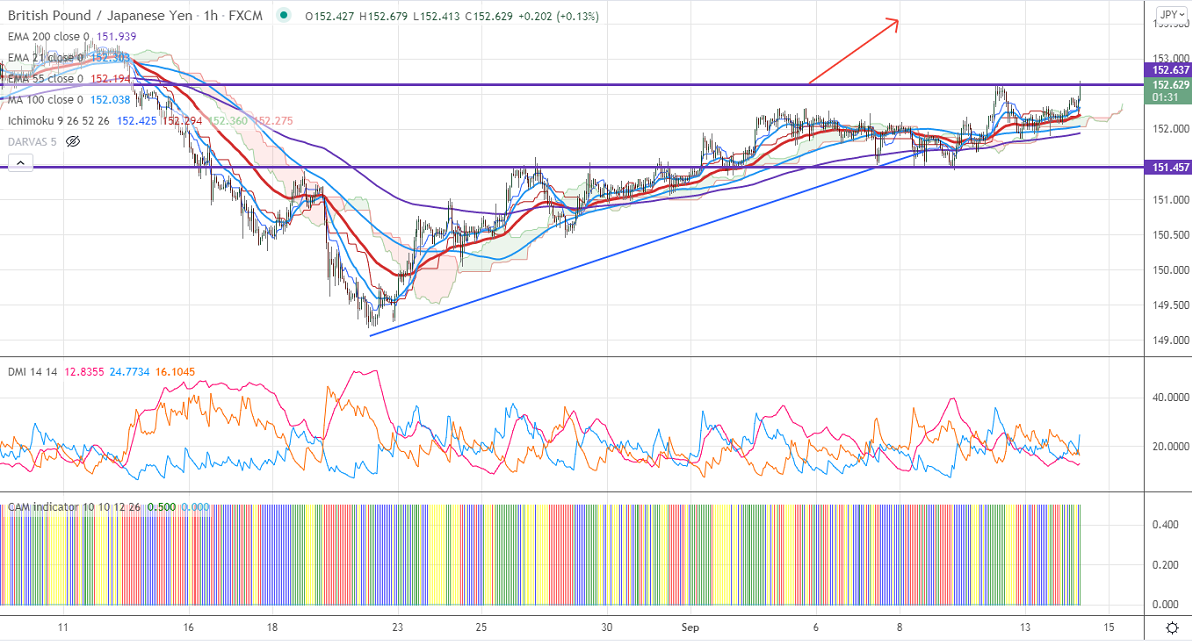

Ichimoku Analysis (1-Hour Chart)

Tenken-Sen- 152.32

Kijun-Sen- 152.18

Major Intraday resistance -152.65

Intraday support- 151.80

GBPJPY is trading higher and surged more than 50 pips on board-based Pound sterling buying. GBPUSD is holding above 1.3850 despite mixed UK jobs data. The number of people who have filed for unemployment benefits declined by 58600 compared to a forecast of -71500. The unemployment rate declined from 4.7% to 4.6%. The intraday trend of GBPJPY is bullish as long as support 151.90 holds.

USDJPY- Analysis

The pair is consolidating in a narrow range between 109.63 and 110.15 for the past three days. The overall trend is neutral as long as resistance 110.80 holds.

Technical:

The pair's immediate resistance is around 152.65, any surge above targets 153/153.50/154.10. Significant bullish continuation if it breaks 153.50. On the lower side, near-term support is around 151.90. Any indicative violation below targets 151.30/150.89/150.45.

Ichimoku Analysis- The pair is trading above hourly Kijun-Sen and below Tenken-Sen

Indicator (Hourly chart)

CAM indicator- Slightly bullish

Directional movement index –Neutral

It is good to buy on dips around 152.50-55 with SL around 151.90 for a TP of 153.55.