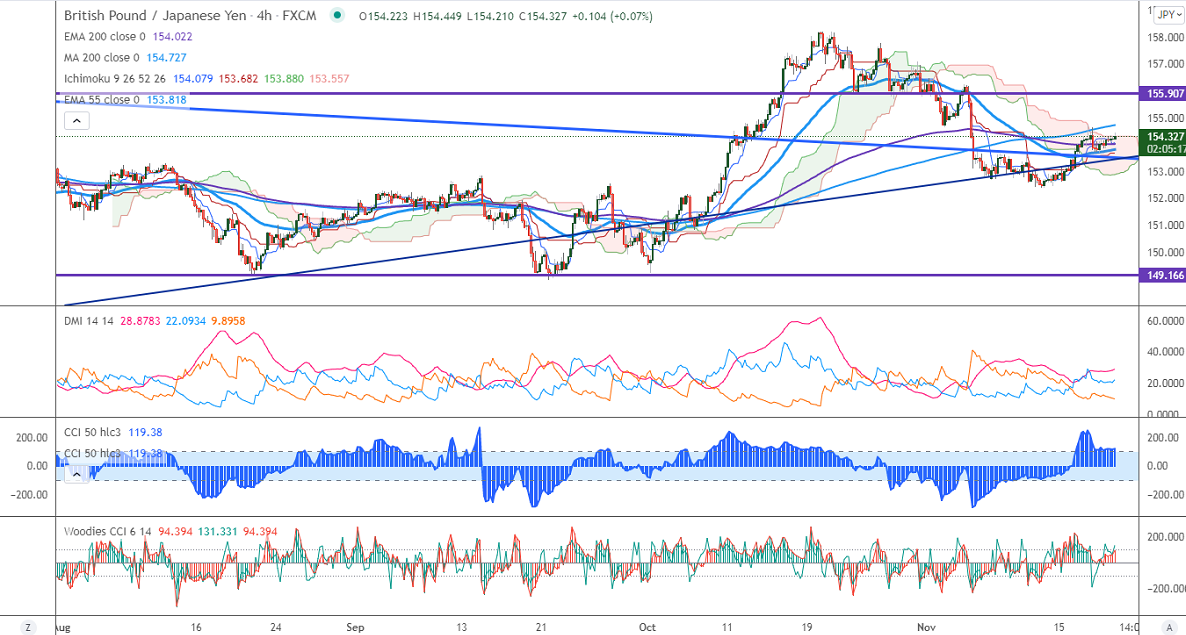

Major Intraday resistance -154.76

Intraday support- 153.74

GBPJPY surged more than 25 pips after upbeat UK retail sales data. It rose by 0.80% in October compared to the forecast of 0.50%. GBPUSD is holding above 1.3500 levels. Any breach above 1.3520 confirms further bullishness. The upbeat CPI has increased hopes of a rate hike by BOE. The intraday trend is bullish as long as support 153.50 holds. It hits an intraday high of 154.449 and is currently trading around 154.397.

USDJPY- Analysis

The pair recovered from the low of 113.84 supported by a jump in US treasury yields. Any violation above 115 confirms bullish continuation.

CCI Analysis-

The CCI (50) and Woodies CCI are holding above zero level in the 4-hour chart. It confirms a minor bullish trend.

Technical:

The immediate resistance is around 154.75, any break above targets 155.35/156. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is around 153.75 Any indicative violation below targets 153/152.50/152.18/151.60.

Indicator (4-Hour chart)

Directional movement index –Bullish

It is good to buy on dips around 154 with SL around 153.40 for a TP of 155.35.