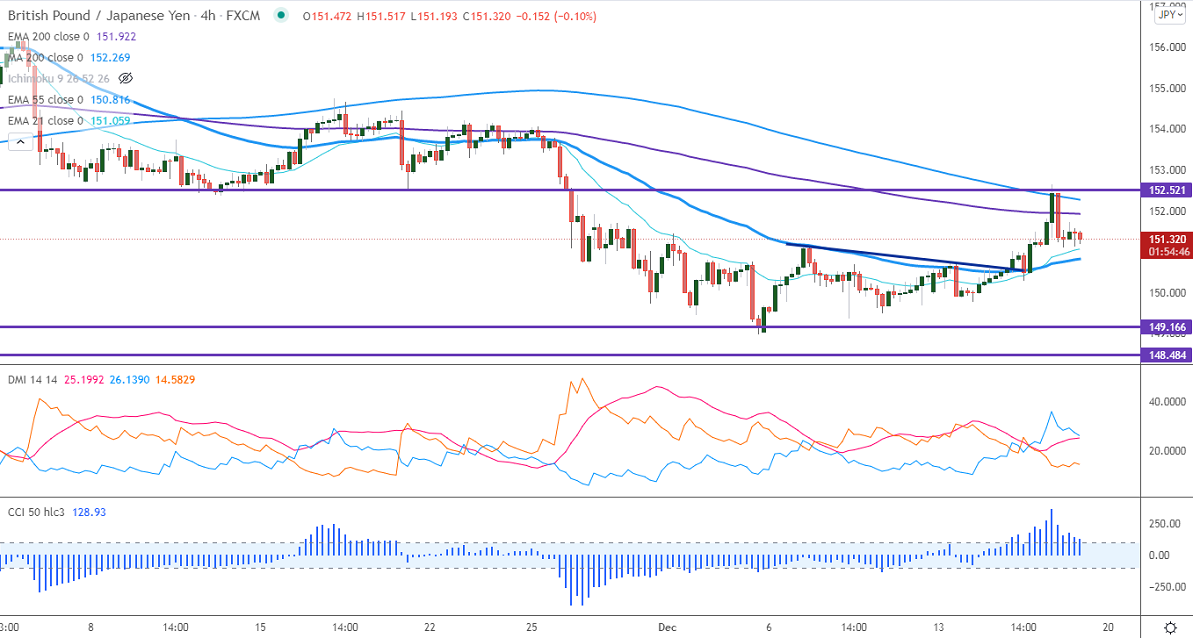

Short-term resistance -152.70

Intraday support- 150.80

GBPJPY surged sharply after the Hawkish Bank of England. The central bank has surprised markets by raising rates from a record low of 0.10% to 0.25% due to a jump in inflation. The pound sterling hits a two-week high against the US dollar at 1.33741. Any breach above 1.3380 confirms intraday bullishness. The intraday trend is bearish as long as resistance 152.50 holds. GBPJPY hits an intraday low of 151.19 and is currently trading around 151.232.

USDJPY- Analysis

The pair dropped more than 50 pips on surge in Coronavirus cases. Any trend continuation if it breaks 115.

CCI Analysis-

The CCI (50) and Woodies CCI hold above zero level in the 4- hour chart. It confirms an intraday bullish trend.

Technical:

The immediate resistance is around 151.50, any break above targets 152/152.60/153/153.52. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is around 150.80. Any indicative violation below targets 150.25/149.70/149.35/148.90.

Indicator (4-Hour chart)

Directional movement index –Neutral

It is good to buy on dips 151.20-25 with SL around 150.50 for a TP of 153.